Question: this is one question (MCQ) separated to five points i want solution with steps to understand it in economic and management subject Edit / i

this is one question (MCQ) separated to five points i want solution with steps to understand it in economic and management subject

Edit / i have copied as it is no informations are needed ! expert asked for more informations but this only data given plz be sure

thnx in advance appreciate ur efforts

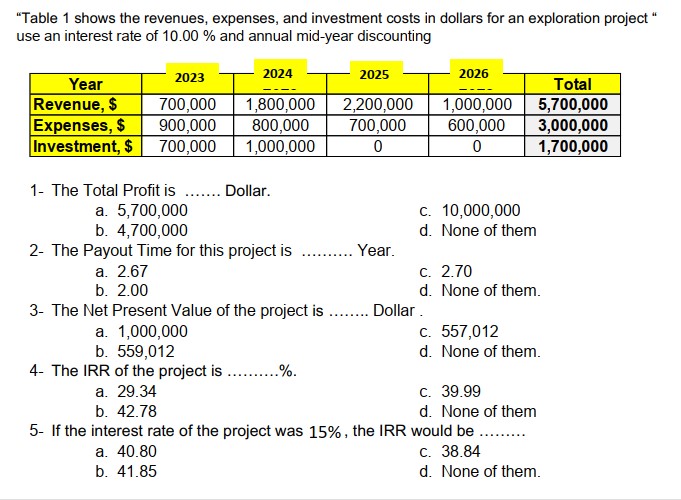

"Table 1 shows the revenues, expenses, and investment costs in dollars for an exploration project use an interest rate of 10.00% and annual mid-year discounting 1- The Total Profit is Dollar. a. 5,700,000 c. 10,000,000 b. 4,700,000 d. None of them 2- The Payout Time for this project is Year. a. 2.67 c. 2.70 b. 2.00 d. None of them. 3- The Net Present Value of the project is Dollar . a. 1,000,000 c. 557,012 b. 559,012 d. None of them. 4- The IRR of the project is %. a. 29.34 c. 39.99 b. 42.78 d. None of them 5- If the interest rate of the project was 15%, the IRR would be a. 40.80 c. 38.84 b. 41.85 d. None of them

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts