Question: This is one question with sections; please zoom in for more details or open image in a new tab. If the full question is not

This is one question with sections; please zoom in for more details or open image in a new tab. If the full question is not answered it will be downvoted.

This is one question with sections; please zoom in for more details or open image in a new tab. If the full question is not answered it will be downvoted.

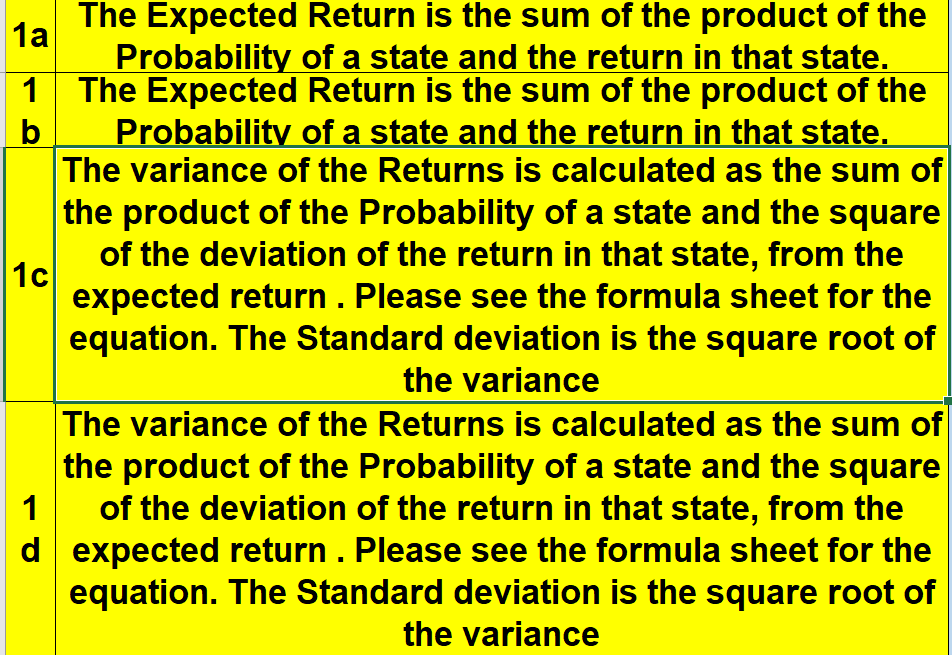

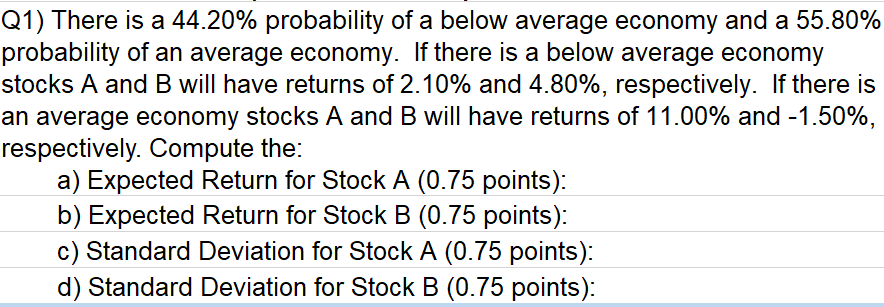

The Expected Return is the sum of the product of the 1a Probability of a state and the return in that state. 1 The Expected Return is the sum of the product of the b Probability of a state and the return in that state. The variance of the Returns is calculated as the sum of the product of the Probability of a state and the square of the deviation of the return in that state, from the 1c expected return . Please see the formula sheet for the equation. The Standard deviation is the square root of the variance The variance of the Returns is calculated as the sum of the product of the Probability of a state and the square 1 of the deviation of the return in that state, from the d expected return . Please see the formula sheet for the equation. The Standard deviation is the square root of the variance 2 Q1) There is a 44.20% probability of a below average economy and a 55.80% probability of an average economy. If there is a below average economy stocks A and B will have returns of 2.10% and 4.80%, respectively. If there is an average economy stocks A and B will have returns of 11.00% and -1.50%, respectively. Compute the: a) Expected Return for Stock A (0.75 points): b) Expected Return for Stock B (0.75 points): c) Standard Deviation for Stock A (0.75 points): d) Standard Deviation for Stock B (0.75 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts