Question: This is one question with sections; please zoom in for more details or open image in a new tab. If the full question is not

This is one question with sections; please zoom in for more details or open image in a new tab. If the full question is not answered it will be downvoted.

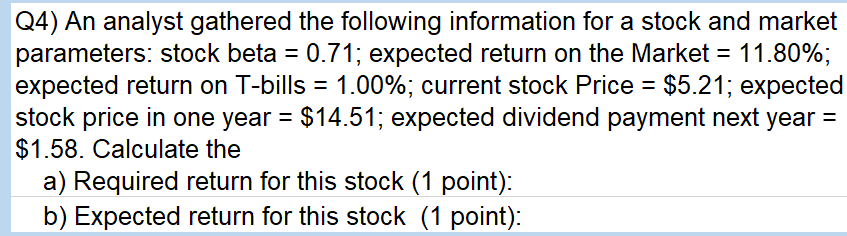

Q4) An analyst gathered the following information for a stock and market parameters: stock beta = 0.71; expected return on the Market = 11.80%; expected return on T-bills = 1.00%; current stock Price = $5.21; expected stock price in one year = $14.51; expected dividend payment next year = $1.58. Calculate the a) Required return for this stock (1 point): b) Expected return for this stock (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts