Question: this is the most clear question i can have please help me as soon as possible im really appreciate Han Riverside Resort opened for business

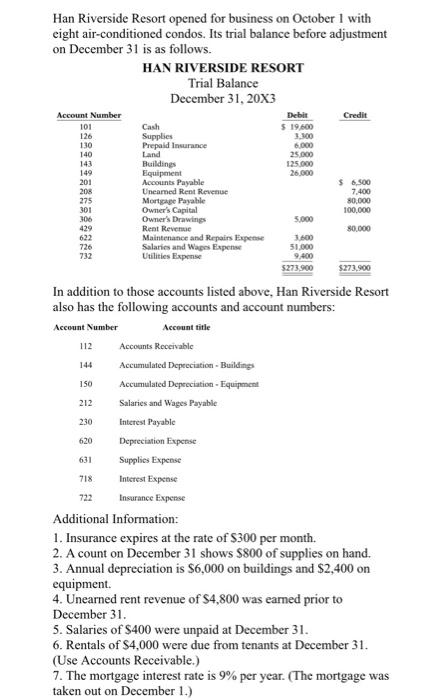

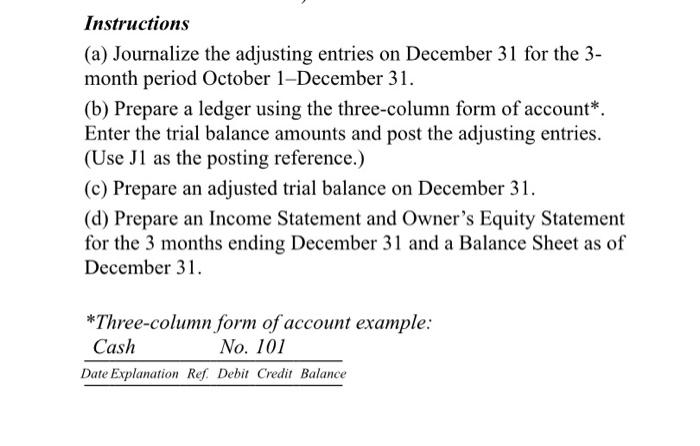

Han Riverside Resort opened for business on October I with eight air-conditioned condos. Its trial balance before adjustment on December 31 is as follows. In addition to those accounts listed above, Han Riverside Resort also has the following accounts and account numbers: Additional Information: 1. Insurance expires at the rate of $300 per month. 2. A count on December 31 shows $800 of supplies on hand. 3. Annual depreciation is $6,000 on buildings and $2,400 on equipment. 4. Unearned rent revenue of $4,800 was eamed prior to December 31 . 5. Salaries of $400 were unpaid at December 31 . 6. Rentals of $4,000 were due from tenants at December 31. (Use Accounts Receivable.) 7. The mortgage interest rate is 9% per year. (The mortgage was taken out on December 1.) Instructions (a) Journalize the adjusting entries on December 31 for the 3month period October 1-December 31 . (b) Prepare a ledger using the three-column form of account*. Enter the trial balance amounts and post the adjusting entries. (Use J1 as the posting reference.) (c) Prepare an adjusted trial balance on December 31 . (d) Prepare an Income Statement and Owner's Equity Statement for the 3 months ending December 31 and a Balance Sheet as of December 31 . *Three-column form of account example: DateExplanationRef.DebitCreditBalanceCash Han Riverside Resort opened for business on October I with eight air-conditioned condos. Its trial balance before adjustment on December 31 is as follows. In addition to those accounts listed above, Han Riverside Resort also has the following accounts and account numbers: Additional Information: 1. Insurance expires at the rate of $300 per month. 2. A count on December 31 shows $800 of supplies on hand. 3. Annual depreciation is $6,000 on buildings and $2,400 on equipment. 4. Unearned rent revenue of $4,800 was eamed prior to December 31 . 5. Salaries of $400 were unpaid at December 31 . 6. Rentals of $4,000 were due from tenants at December 31. (Use Accounts Receivable.) 7. The mortgage interest rate is 9% per year. (The mortgage was taken out on December 1.) Instructions (a) Journalize the adjusting entries on December 31 for the 3month period October 1-December 31 . (b) Prepare a ledger using the three-column form of account*. Enter the trial balance amounts and post the adjusting entries. (Use J1 as the posting reference.) (c) Prepare an adjusted trial balance on December 31 . (d) Prepare an Income Statement and Owner's Equity Statement for the 3 months ending December 31 and a Balance Sheet as of December 31 . *Three-column form of account example: DateExplanationRef.DebitCreditBalanceCash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts