Question: this is the solution format this the problem to be solve; 3.1 A and Blood internation of March 1, 2011 by invictim 125,000 and P76,000,

this is the solution format

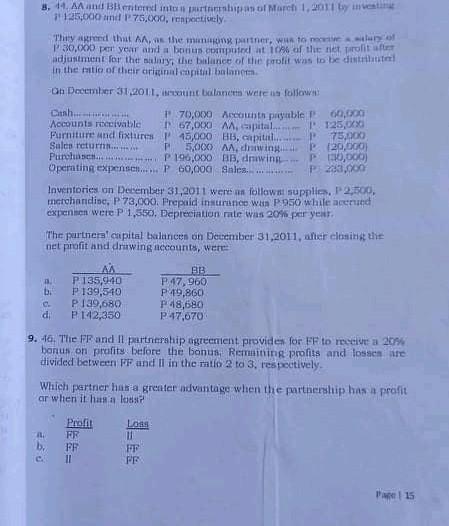

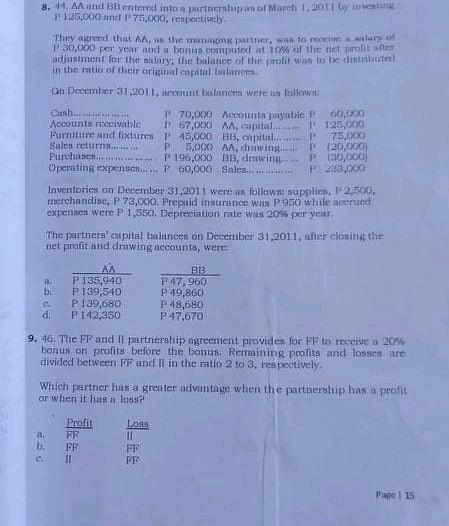

this the problem to be solve;

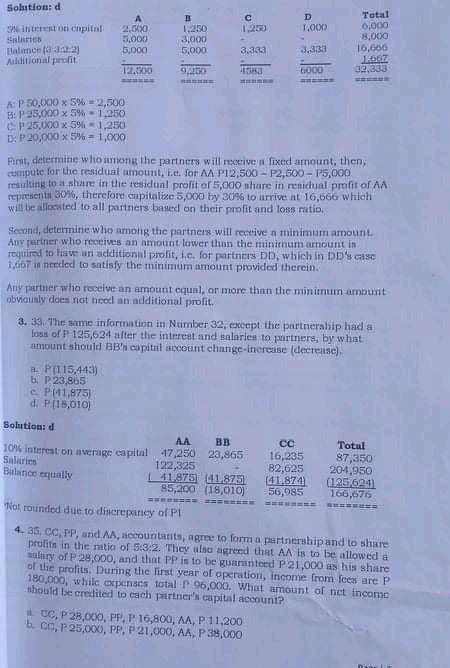

3.1 A and Blood internation of March 1, 2011 by invictim 125,000 and P76,000, repectively Thered that the mannertner, was to 30.000 per year and a bonus comptat 10% of the net rolife adjustment for the salary, the balance of the polit was to be deti in the natio or their original copiti balnem On December 31, ant balance were in follow 170,000 Accounth payable 60,000 Mocounts receivable 67,000 Aapital 125,000 Furniture and fixtures P15,000 B, capital P75,000 Sales retur 5,00X AA mwing P120,000 Purchase. 196.000 BB, dniwing P0,000) Operating expenses... P60,000 Sales P20,000 Inventories on December 31, 2011 were an follow supplies, P2,500, merchandise, P73,000. Prepaid insurance wa 950 while accrued expennen were P1,550, Depreciation rate was 20% per year. The purtneral capital balancen on December 31,2011, after closing the net profit and drawing accounts, were MA 33 P 135.940 47,960 bi P 139,510 P119,860 C P 139,680 48,680 di 1:42,350 p 47,070 9. 16. The FF and Il partnership agreement provides for FF to receive a 2018 bonus on profits before the bonus, Remning profits and losse te divided between PF and Il in the mto 2 to 3, respectively Which partner has a greater advantage when the partnership has a profit ar when it has a loss Pro FR FE bi FF PR 15 di 1 11 Solution: 1.200 D 1.00 S Balance 302 Auditional profit 2.000 5.000 5,000 31000 5,000 Total 0,000 8.000 16.666 2567 32,333 3.333 3,333 123.0 940 6000 A: P 50,000 x 5% -2,500 55: P 35,000 x 5% -1.250 P 25,000 x 5% -1,250 D: 20,000 x 5% -1,6X0 Forst, determine who among the partners will fixed amount, then compute for the residual amount .. for AA P12,500 - P2,500 - 15,000 resulting to a stare in the residual profit or 5,000 share in rechal profit of AA representat 30%, therefore cupitilize 5,000 by 30% to irrive at 16,666 which will be allocated to all partners based on their profit and loss ratio Sernd, determine who among the partners will retive a minimum amount Any partner who receives an amount lower than the minimum amount in required to have an additional profit, l.c. for partner DD, which in DD's 1,67 in needed to satisfy the minimum amount provided therein Any partner who receive an amount equal or more than the minimum amount obviously does not need an additional profit. 3. 33. The same information in Number 32, except the partnership had a loss of P 125,624 after the interest and salaries to partners, by what amount should BB's capital count change-increase (decrease) - P(115,443) bp 23.865 c P41,875) d P[15,010) Solution: d AA BB Totul 10% interest on average capital 47,250 22,865 16,235 87,350 Salaris 122,325 82,625 204,950 41.875 1875 (41 874 (125,624 85,200 (18,010) 56,985 166,676 ==== Not rounded due to discrepancy of P! 4.36. C, PP, und A, accountants, agree to forma partnership and to share prolit in the nitia of 5:32. They also agreed that AA is to be allowed a salary of P28,000, and that PP is to be guaranteed P21,000 as his share of the profits. During the first year of operation, income from fees are P 180.000, while expenses total 96,000. What amount of net income should be credited to each partner's capital account? C, P 28.000, PP.P 16,800, AA, P.11.200 ho, P25,000, PP, P 21,000, AA, P35,000 Balance sually di 1 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts