Question: this is the third time ive posted this and im very confused please help. Entries for Selected Corperate Transactions Selected transactions completed by ATV Discount

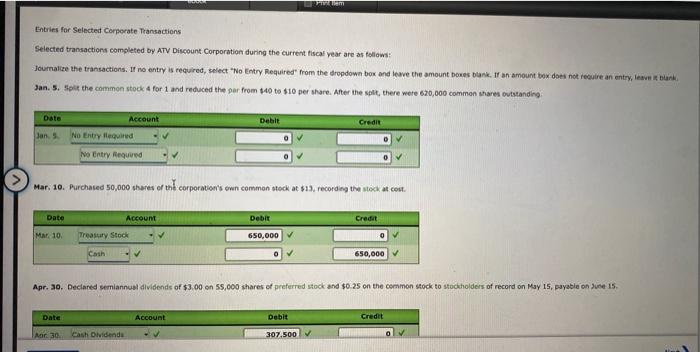

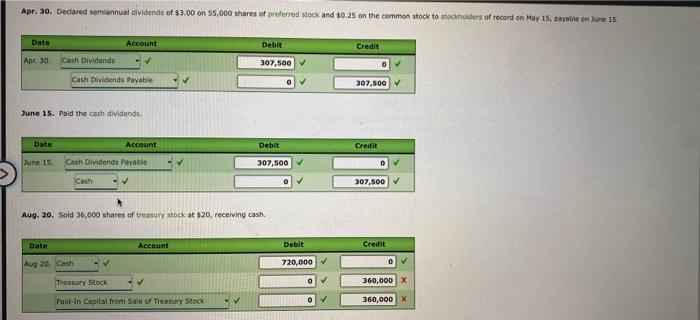

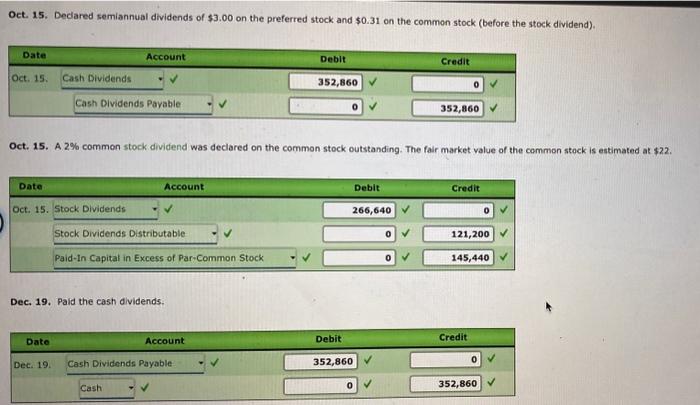

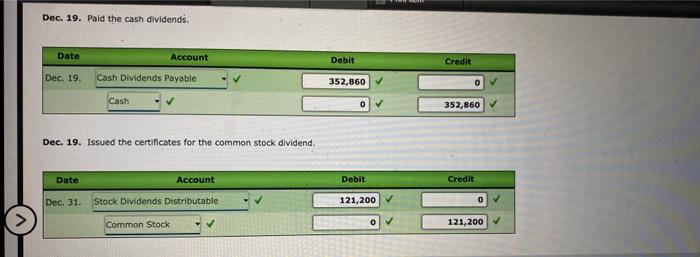

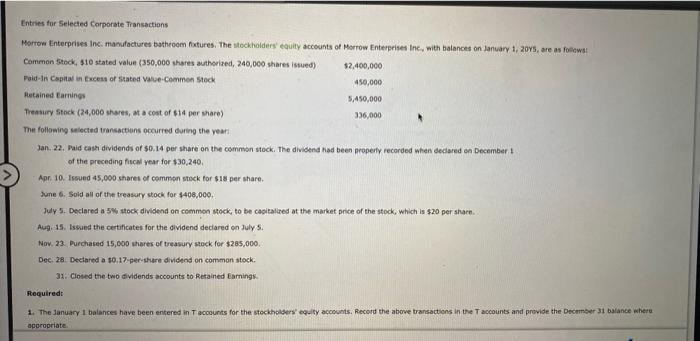

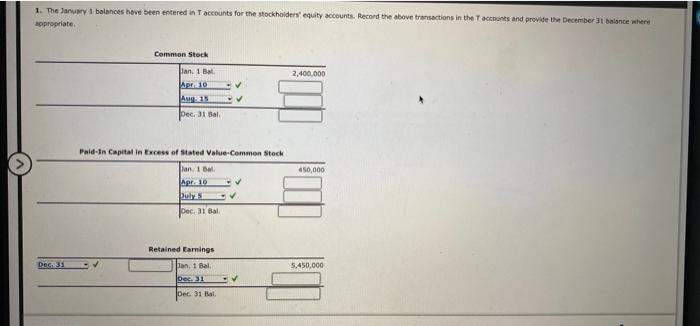

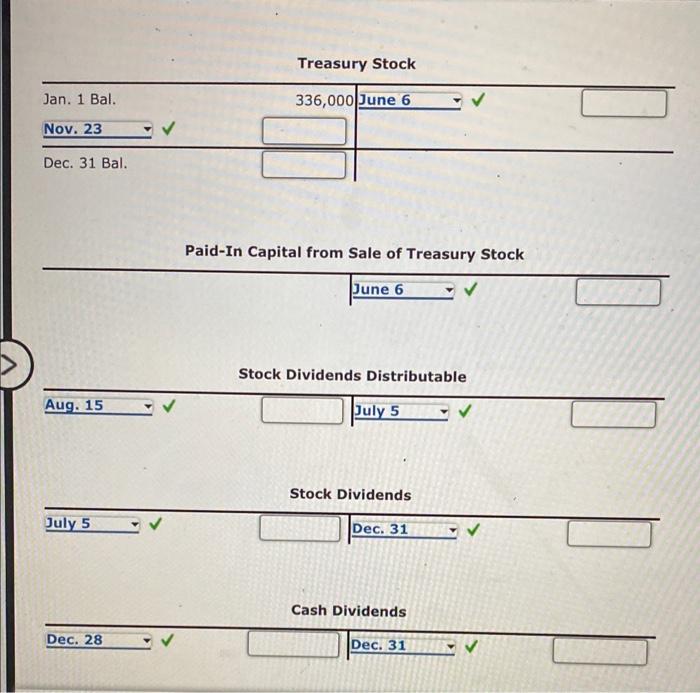

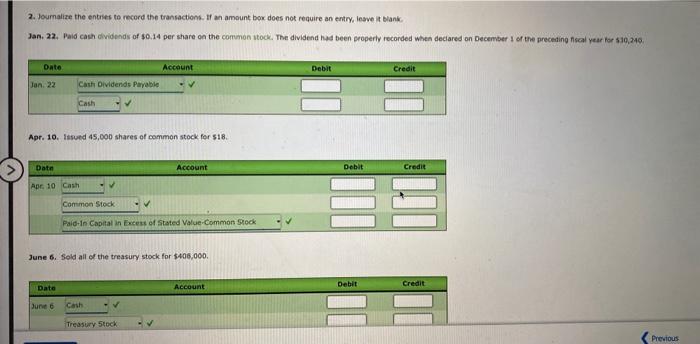

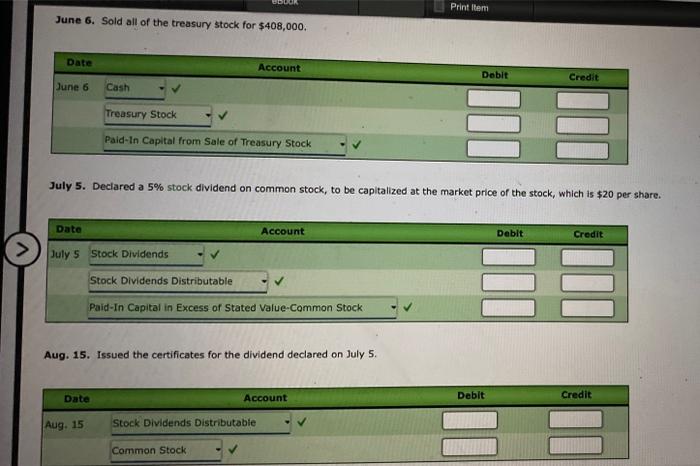

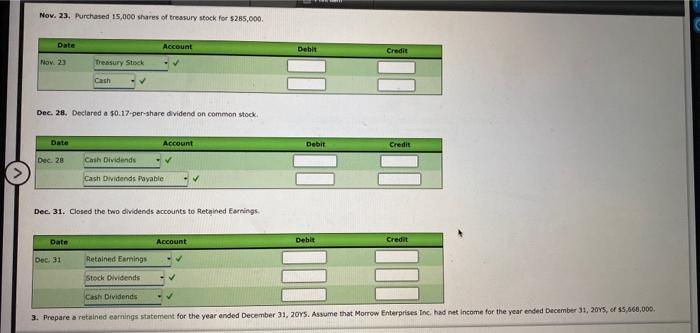

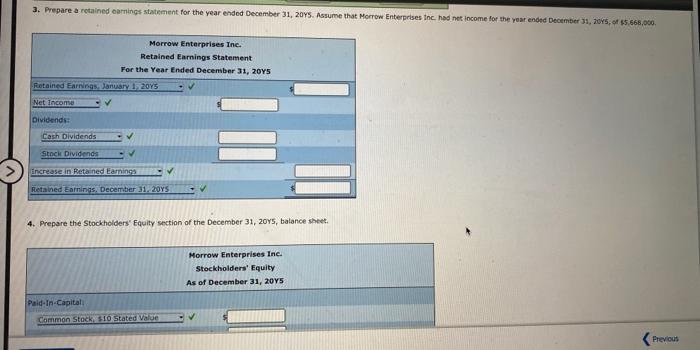

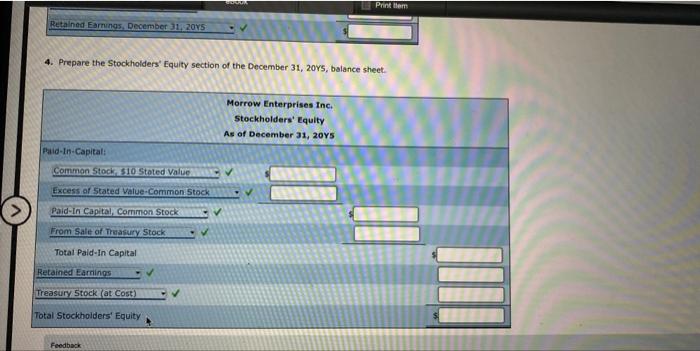

Entries for Selected Corperate Transactions Selected transactions completed by ATV Discount Corporation during the current fiscal year are as feliows: 3aA. 5. 5ole the common stock 4 for 1 and reduced the par from $40 to $10 per share. After the splt, there wete 620,000 common shares outstanding Mar. 10. Purchased 50,000 shares of the corporation's own common stock at \$13, recordieg, the stocik at cest. June 15. Paid the canh dividends. Aug. 20. Sold 36,000 shares of treasury stock at $20, receiving cash. Oct. 15. Dedared semiannual dividends of $3.00 on the preferred stock and $0.31 on the common stock (before the stock dividend). Oct. 15. A 2% common stock dividend was declared on the common stock outstanding. The fair market value of the common stock is eatimated at $22. Dec. 19. Paid the cash dividends. Dec. 19. Paid the cash dividends. Dec. 19. Issued the certificates for the common stock dividend. Entries for Selected Corporate Jransactions Horrow Enterprises inc. masufactures bathroom fotures. The stockholders' equily accounts of Morrow Enterpeiset inc, with balances an Janwary 1, 20ys, are as foicwat Jan. 22. Paid cash dividends of $0.14 per share on the common stock. The dividend had been properly recorded when dedised on December : of the preceding fiscal year for $30,240. Apr. 10. Issued 45,000 sharet of common stock for \$1s per share. June 6. Sold all of the treasary stock for $408,000. July 5. Deciared a 5% shock dividend on common stock, to be capitalled at the market price of the stock, which is 520 per share. Aug. 15. Issued the certificates for the dividend deciared en July 5 . Nov. 23 . Purchased 15,000 stares of treasury stock for $285,000. Dec: 28. Dectared a s0.17-per-shere dividend on common stock. 31. Cosed the two dividends acoounts to Retained Carningik. Prequiredt 1. The January I balances have been entered in T acoounts for the stockholders' equily acoconts. Fiecord the above transactions in the T accounts and provide the Decmiser 31 balance where aporopriate. 1. The January II balances have been entered in T accounts for the stockholders' equity accounts. Record the above transsctions in the T accounts and provide the December 31 balsice mhere appropriate. Faid-In Capital is Ercess of stated Value-Common stock Paid-In Capital from Sale of Treasury Stock Stock Dividends Distributable Stock Dividends Cash Dividends 2. Joumalize the entries to record the transactions. If an amount box does not require an entry, lesve it Blank. Jan. 22. Paid cash cividends of \$0.14 per share on the commen stock. The dividend had been properly roconded when deciared on December I of the preceting fiscal year ior $30,240. Apr. 10. Iisued 45,000 shares of common stock for 518. June 6. Sold all of the treasury stock for $406,000. June 6. Sold all of the treasury stock for $408,000. July 5. Declared a 5% stock dividend on common stock, to be capitalized at the market price of the stock, which is $20 per Aug. 15. Issued the certificates for the dividend declared on July 5. Novi 23. Purchased 15,000 shares of treasury stock for 5285,000 . Dec. 28. Deciared a 50.17 -per-share dividend on common stock Dec. 31. Closed the two dividends accounts to Retained Farnings. 4. Prepare the Stockholders' Equity section of the December 31, 20r5, balance sheet. 4. Prepare the 'Stockholders' Equity section of the December 31, 20v5, balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts