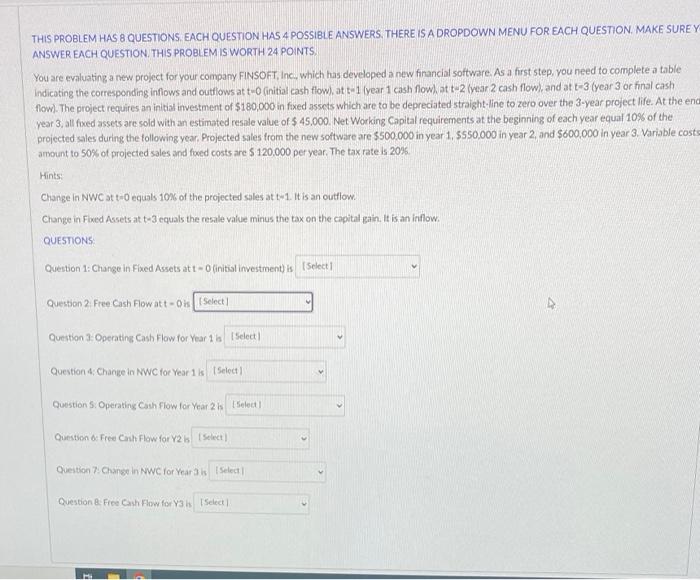

Question: THIS PROBLEM HAS B QUESTIONS EACH QUESTION HAS 4 POSSIBLE ANSWERS, THERE IS A DROPDOWN MENU FOR EACH QUESTION. MAKE SURE Y ANSWER EACH QUESTION.

THIS PROBLEM HAS B QUESTIONS EACH QUESTION HAS 4 POSSIBLE ANSWERS, THERE IS A DROPDOWN MENU FOR EACH QUESTION. MAKE SURE Y ANSWER EACH QUESTION. THIS PROBLEM IS WORTH 24 POINTS You are evaluating a new project for your company FINSOFT, Inc., which has developed a new financial software. As a first step, you need to complete a table Indicating the corresponding inflows and outflows att-Ginitial cash flow), at t-1 year 1 cash flow) ott 2 year 2 cash flow), and at t-3 (Year 3 or final cash flow). The project requires an initial investment of $180,000 in fixed assets which are to be depreciated straight-line to zero over the 3-year project life. At the end year 3, all fixed assets are sold with an estimated resale value of $ 45,000. Net Working Capital requirements at the beginning of each year equal 10% of the projected sales during the following year Projected sales trom the new software are $500.000 in year 1, 5550,000 in year 2, and $600,000 in year 3 Variable costs amount to 50% of projected sales and frowed costs are $ 120,000 per year. The tax rate is 20% Hints: Change in NWC att equals 10% of the projected sales at t-1. It is an outflow. Change in Fixed Assets at t-3 equals the resale value minus the tax on the capital gain. It is an inflow. QUESTIONS Question 1: Change in Fixed Assets att initial investment) is Select Question 2 Free Cash Flowatt-on Select Question Operating Cash Flow for Year 16 Select Question 4 Change in NWC for Year 1 Select Questions Operating Cash Flow for Year 2 Select Question : Free Cash Flow for Y2 is Select Question 7. Change in NWC Yor Year is Select Question Free Cash Flow for Yas Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts