Question: THIS PROBLEM HAS 8 QUESTIONS. EACH QUESTION HAS 4 POSSIBLE ANSWERS. THERE IS A DROPDOWN MENU FOR EACH QUESTION. MAKE SURE YOU ANSWER EACH QUESTION.

THIS PROBLEM HAS QUESTIONS. EACH QUESTION HAS POSSIBLE ANSWERS. THERE IS A DROPDOWN MENU FOR EACH QUESTION. MAKE SURE YOU ANSWER EACH QUESTION.

You are evaluating a new project for your company FINSOFT, Inc., which has developed a new financial software. The project requires an initial investment of $ in fixed assets which are to be depreciated straightline to zero over the year project life. At the end of year all fixed assets are sold for an estimated resale value of $ Net Working Capital requirements at the beginning of each year equal of the projected sales during the following year. Projected sales from the new software are $ in year $ in year and $ in year The variable costs amount to of projected sales and fixed costs are $ per year. The tax rate is

Hints:

Change in NWC at equals of the projected sales at It is an outflow.

Change in Fixed Assets at equals the resale value minus the tax on the capital gain. It is an inflow.

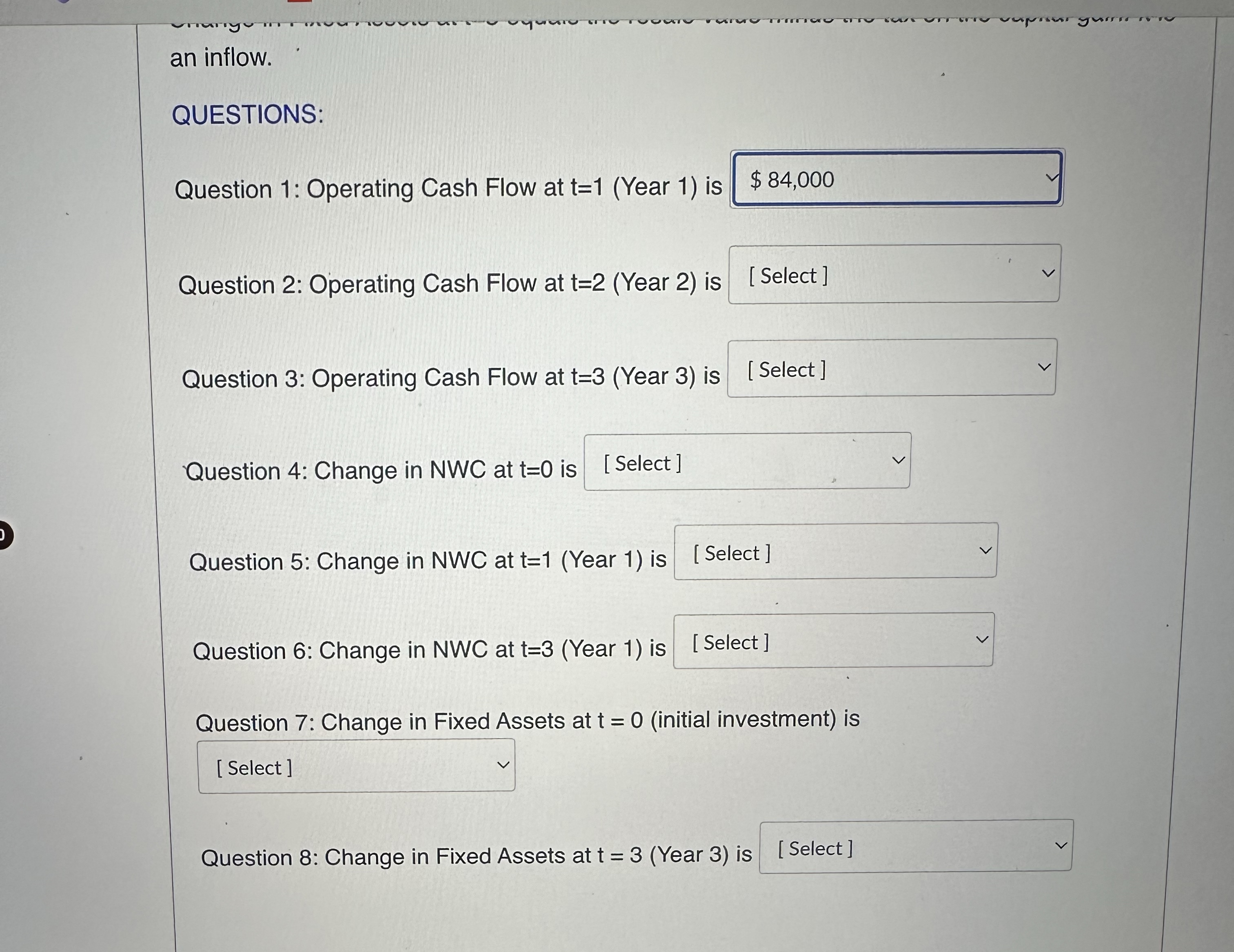

QUESTIONS:

Question : Operating Cash Flow at Year is

an inflow.

QUESTIONS:

Question : Operating Cash Flow at Year is

Question : Operating Cash Flow at Year is

Question : Operating Cash Flow at Year is

Question : Change in NWC at is

Question : Change in NWC at Year is

Question : Change in NWC at Year is

Question : Change in Fixed Assets at initial investment is

Question : Change in Fixed Assets at Year is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock