Question: This problem has NO relation to the problem in Part 1 The current risk - free rate is 5 . 5 1 % and the

This problem has NO relation to the problem in Part

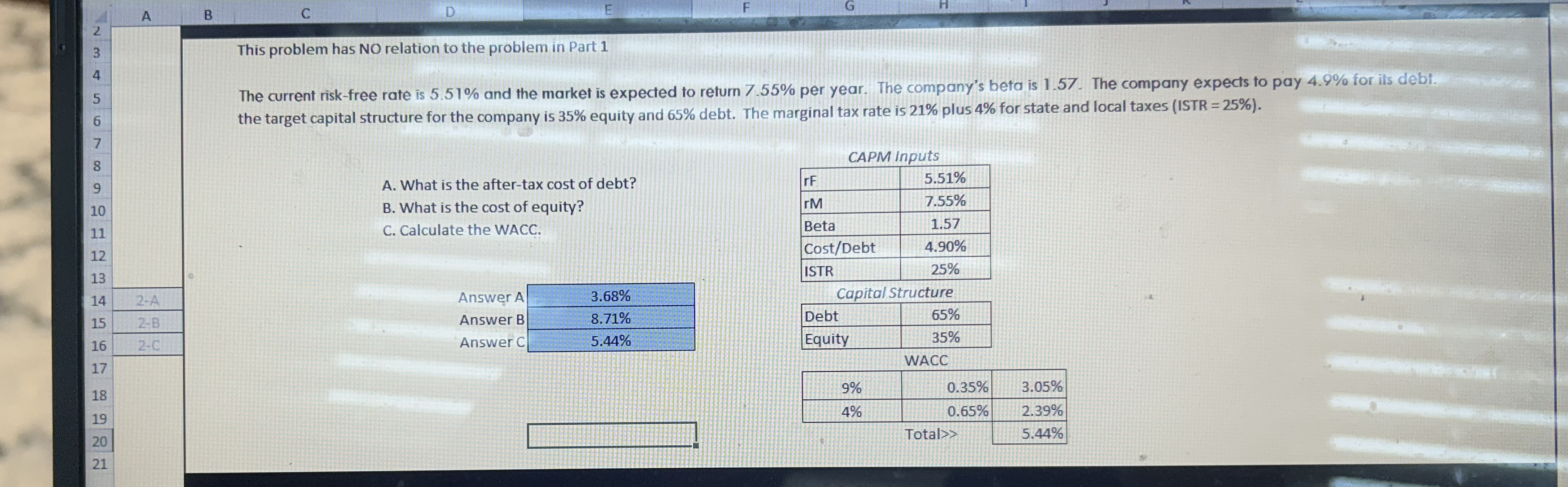

The current riskfree rate is and the market is expected to return per year. The company's beta is The company expects to pay for its debl. the target capital structure for the company is equity and debt. The marginal tax rate is plus for state and local taxes ISTR

CAPM Inputs

A What is the aftertax cost of debt?

B What is the cost of equity?

C Calculate the WACC.

tablerF

Please show me how to put these into formulas on excel for the blue cells shown in the picture

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock