Question: (This Question has the same problem statement as above) You are evaluating the acquisition of a new ski machine. Its price is $200,000, and it

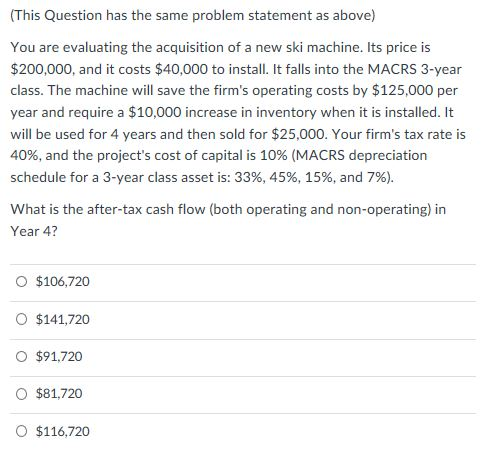

(This Question has the same problem statement as above) You are evaluating the acquisition of a new ski machine. Its price is $200,000, and it costs $40,000 to install. It falls into the MACRS 3-year class. The machine will save the firm's operating costs by $125,000 per year and require a $10,000 increase in inventory when it is installed. It will be used for 4 years and then sold for $25,000. Your firm's tax rate is 40%, and the project's cost of capital is 10% (MACRS depreciation schedule for a 3-year class asset is: 33%, 45%, 15%, and 7%). What is the after-tax cash flow (both operating and non-operating) in Year 4? O $106,720 O $141,720 O $91,720 O $81,720 O $116,720

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts