Question: This question is read the question above and use the chart to answer the multiple choice from question 6-7. Solvency Solvency is a firm's ability

This question is read the question above and use the chart to answer the multiple choice from question 6-7.

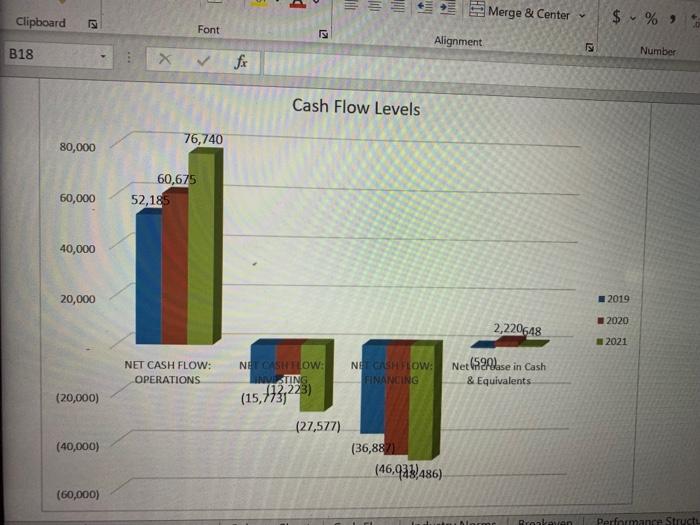

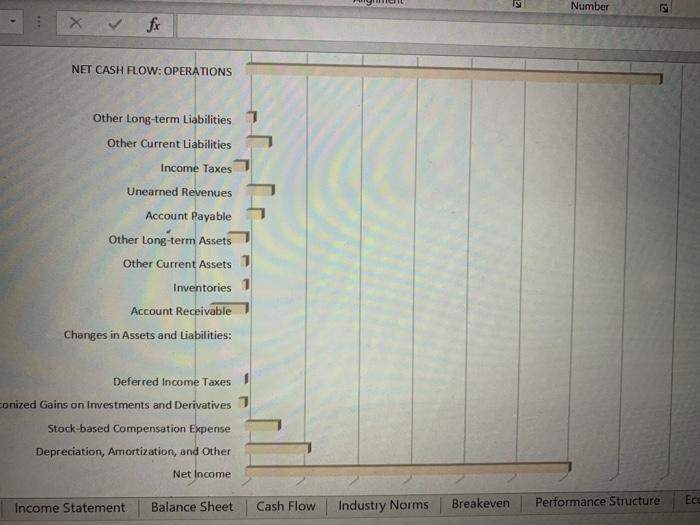

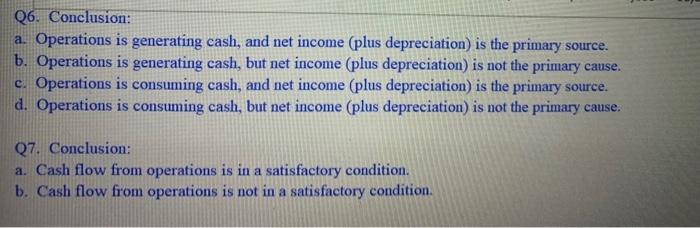

Solvency Solvency is a firm's ability to pay debt and obligations by using its cash flows. A firm is solvent if it generates more cash than it consumes; it has a zero or positive net cash flow. Cash flow represents the cash outlays and receipts over a given period of time. A positive total cash flow is generally necessary for the survival of the firm; the alternative is to draw down any cash reserve in the bank, sell additional equity in the business, or borrow additional cash. Net cash flow is a function of three sources of cash: operations, investing, and financing. In the short run, one source may off-set negative cash flow from another source. However, the long-run solvency of the business requires positive cash flow from operations because investing and financing activities, alone, cannot generate cash indefinitelv. P = + Merge & Center Clipboard $ % 21 Font KI Alignment B18 Number fx Cash Flow Levels 76,740 80,000 60,675 52,185 60,000 40,000 20,000 2019 2020 2,220648 2021 NET CASH FLOW: OPERATIONS (20,000) NE CASH FLOW: NE GASHFLOW: Net (594ase in Cash LETING FINANCING & Equivalents (15,7731 113,223) (27,577) (36,8821 (46,988,486) (40,000) (60,000) Rronan Performance Structu Cashflow from Operations Cash flows from operations are cash amounts expended and received in the normal operations of the business. Thus, these cash flows correspond primarily to the income statement accounts, but also reflect changes in current asset accounts. When net cash flow from operations is positive, it indicates that the business operations are generating cash. . Number NET CASH FLOW: OPERATIONS Other Long-term Liabilities Other Current Liabilities Income Taxes Unearned Revenues Account Payable Other Long-term Assets Other Current Assets 1 Inventories 1 Account Receivable Changes in Assets and Liabilities: Deferred Income Taxes onized Gains on Investments and Derivatives 3 Stock-based Compensation Expense Depreciation, Amortization, and other Net Income Income Statement Balance Sheet Cash Flow Eco Breakeven Industry Norms Performance Structure Q6. Conclusion: a. Operations is generating cash, and net income (plus depreciation) is the primary source. b. Operations is generating cash, but net income (plus depreciation) is not the primary cause. c. Operations is consuming cash, and net income (plus depreciation) is the primary source. d. Operations is consuming cash, but net income (plus depreciation) is not the primary cause. Q7. Conclusion: a. Cash flow from operations is in a satisfactory condition. b. Cash flow from operations is not in a satisfactory condition

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock