Question: This question will be sent to your instructor for grading. 1 a In 2 0 1 7 , Jackie, an individual, intends to invest in

This question will be sent to your instructor for grading.

a

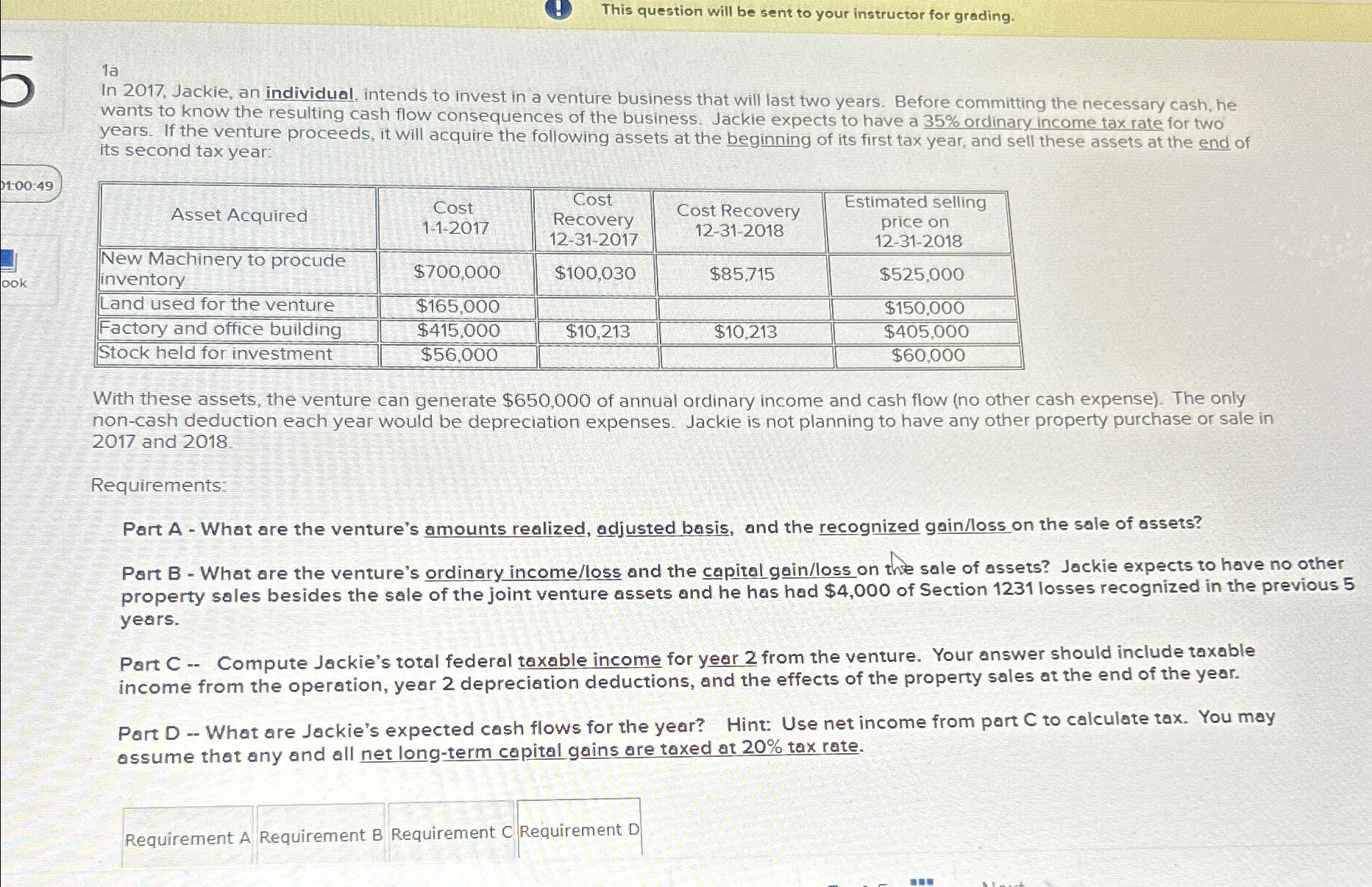

In Jackie, an individual, intends to invest in a venture business that will last two years. Before committing the necessary cash, he wants to know the resulting cash flow consequences of the business. Jackie expects to have a ordinary income tax rate for two years. If the venture proceeds, it will acquire the following assets at the beginning of its first tax year, and sell these assets at the end of its second tax year:

tableAsset Acquired,tableCost

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock