Question: This question will be solved according to these tables. 1. Mrs. D is living in zmir, leased out his flat as residency premises in zmir

This question will be solved according to these tables.

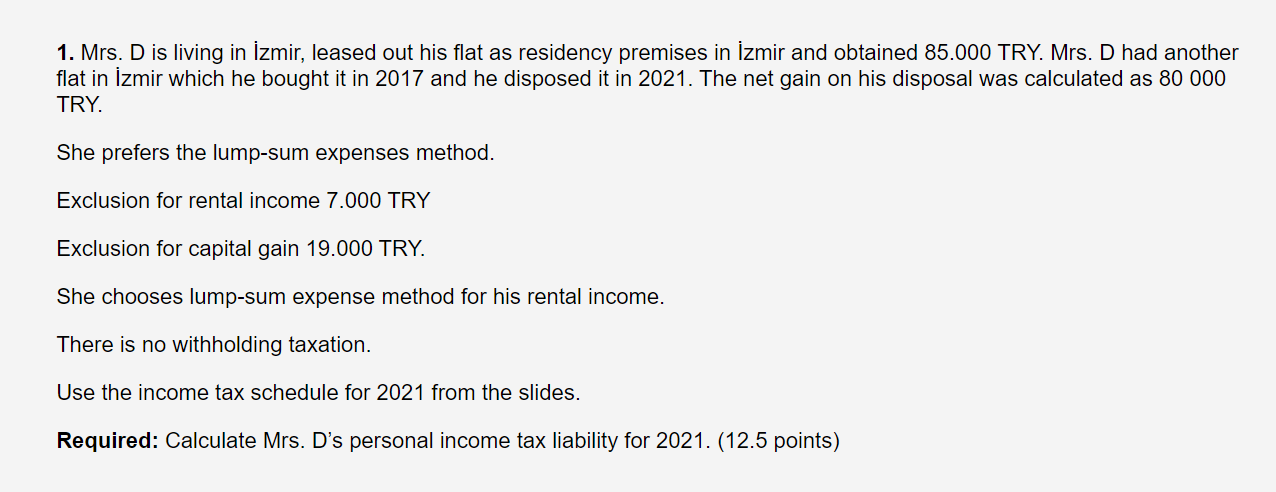

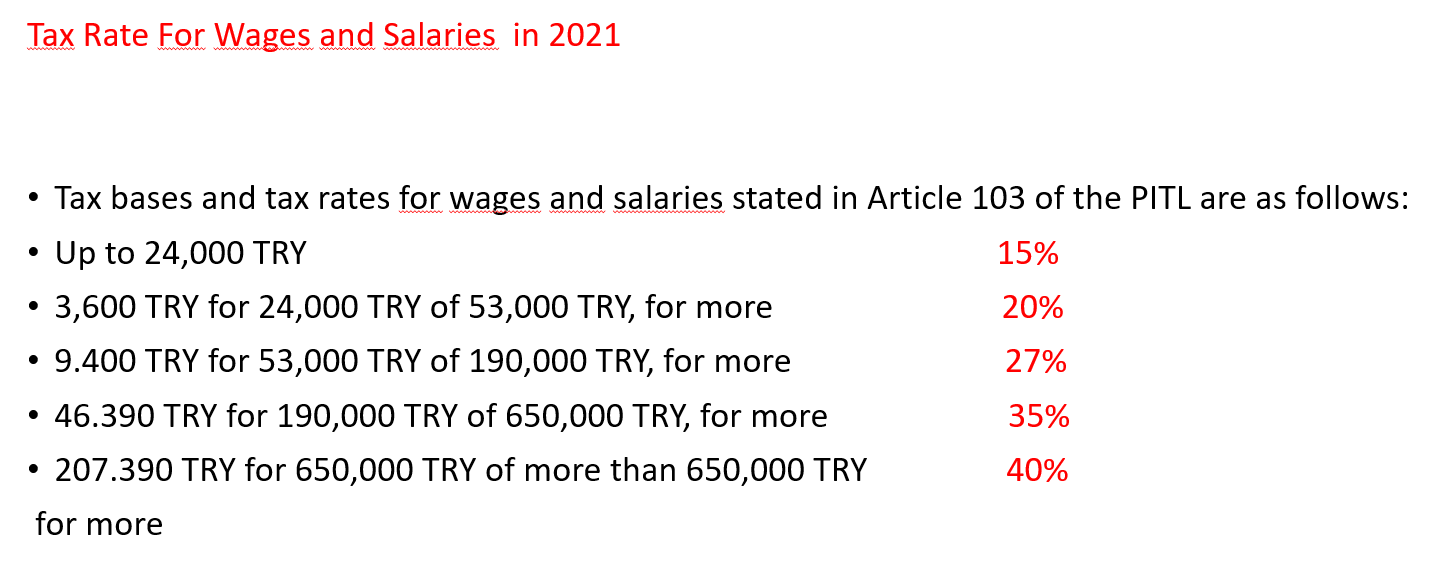

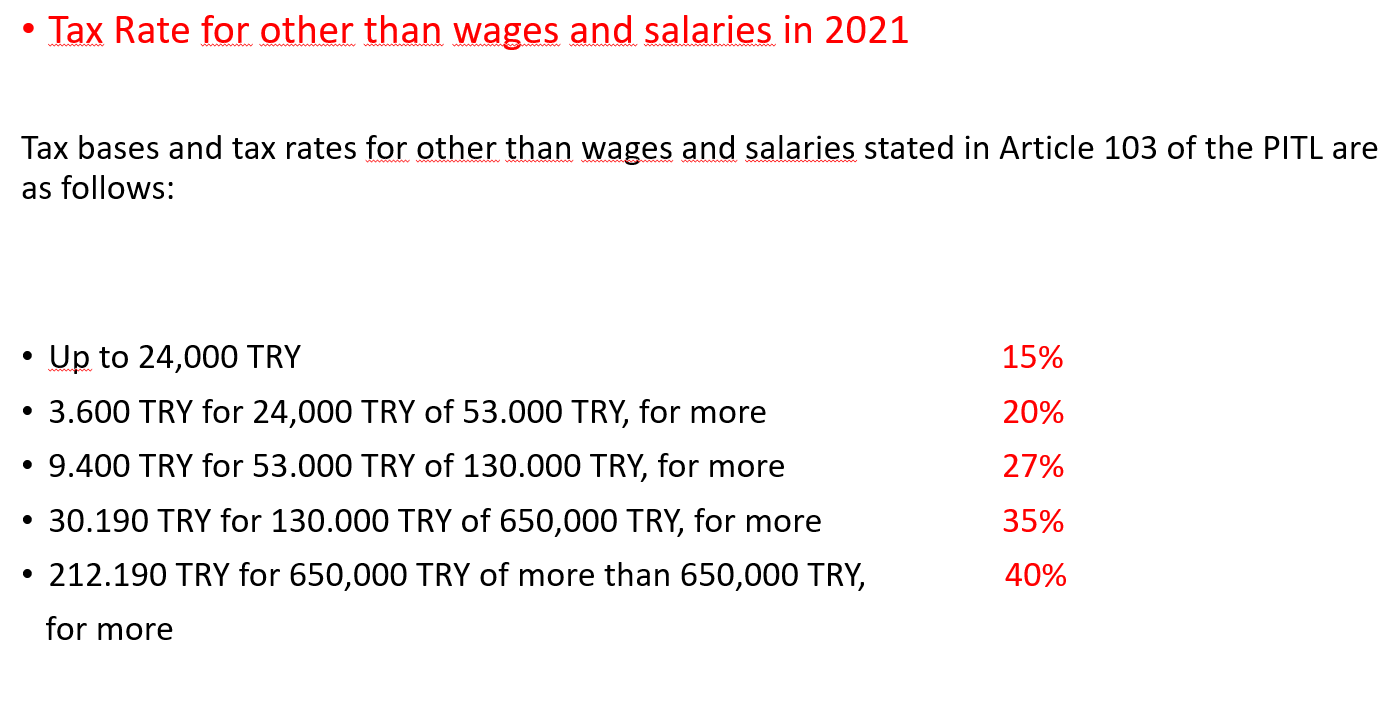

1. Mrs. D is living in zmir, leased out his flat as residency premises in zmir and obtained 85.000 TRY. Mrs. D had another flat in zmir which he bought it in 2017 and he disposed it in 2021. The net gain on his disposal was calculated as 80 000 TRY. She prefers the lump-sum expenses method. Exclusion for rental income 7.000 TRY Exclusion for capital gain 19.000 TRY. She chooses lump-sum expense method for his rental income. There is no withholding taxation. Use the income tax schedule for 2021 from the slides. Required: Calculate Mrs. D's personal income tax liability for 2021. (12.5 points) Tax Rate For Wages and Salaries in 2021 Tax bases and tax rates for wages and salaries stated in Article 103 of the PITL are as follows: Up to 24,000 TRY 15% 3,600 TRY for 24,000 TRY of 53,000 TRY, for more 20% 9.400 TRY for 53,000 TRY of 190,000 TRY, for more 27% 46.390 TRY for 190,000 TRY of 650,000 TRY, for more 35% 207.390 TRY for 650,000 TRY of more than 650,000 TRY 40% . for more Tax Rate for other than wages and salaries in 2021 Tax bases and tax rates for other than wages and salaries stated in Article 103 of the PITL are as follows: 15% 20% Up to 24,000 TRY - 3.600 TRY for 24,000 TRY of 53.000 TRY, for more 9.400 TRY for 53.000 TRY of 130.000 TRY, for more 30.190 TRY for 130.000 TRY of 650,000 TRY, for more 212.190 TRY for 650,000 TRY of more than 650,000 TRY, 27% 35% 40% for more

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts