Question: This tab, graduated tax table for Individuals, is for reference for computing the income tax due in Part 2 Use the table below to compute

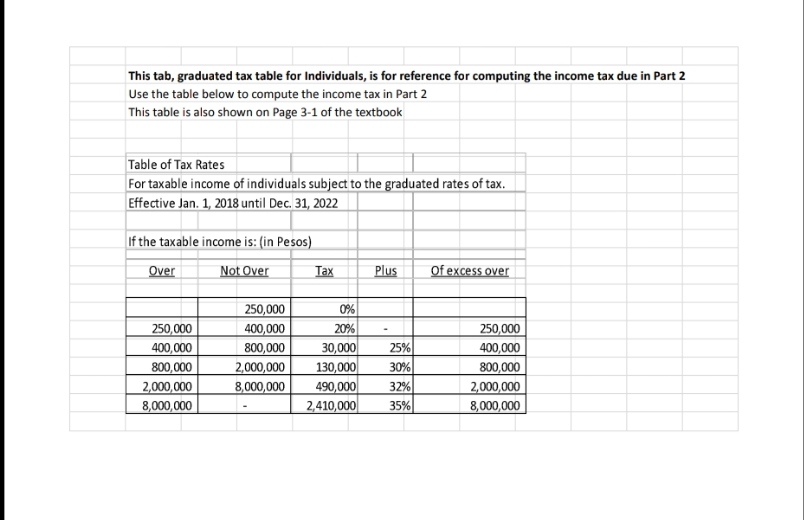

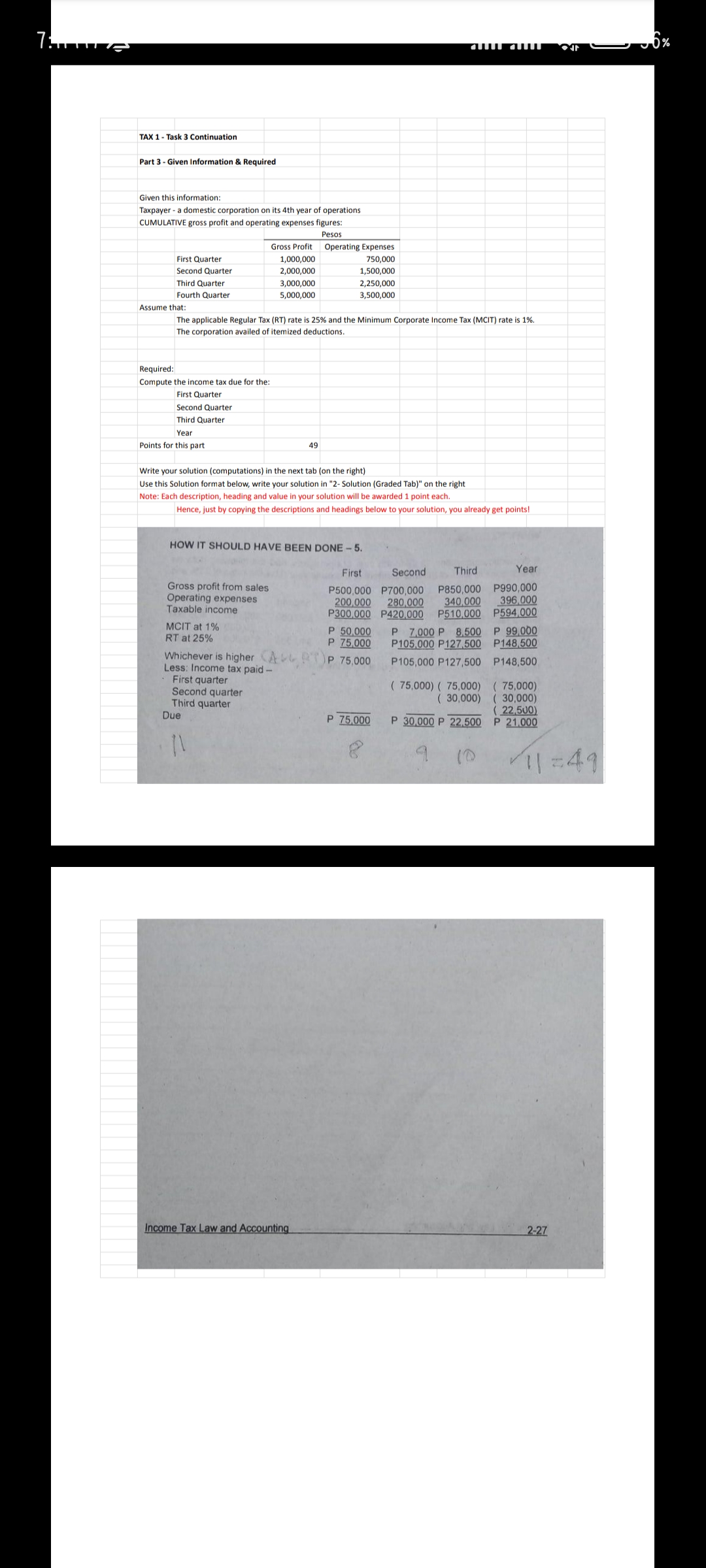

This tab, graduated tax table for Individuals, is for reference for computing the income tax due in Part 2 Use the table below to compute the income tax in Part 2 This table is also shown on Page 3-1 of the textbook Table of Tax Rates For taxable income of individuals subject to the graduated rates of tax. Effective Jan. 1, 2018 until Dec. 31, 2022 If the taxable income is: (in Pesos) Over Not Over Tax Plus Of excess over 250,000 0% 250,000 400,000 20% 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,0006% TAX 1 - Task 3 Continuation Part 3 - Given Information & Required Given this information: Taxpayer - a domestic corporation on its 4th year of operations CUMULATIVE gross profit and operating expenses figures: Pesos Gross Profit Operating Expenses First Quarter 1,000,000 750,000 Second Quarter 2,000,000 ,500,000 Third Quarter 3,000,000 2,250,000 Fourth Quarter 5,000,000 3,500,000 Assume that: The applicable Regular Tax (RT) rate is 25% and the Minimum Corporate Income Tax (MCIT) rate is 1%. The corporation availed of itemized deductions. Required Compute the income tax due for the: First Quarter Second Quarter Third Quarter Yea Points for this part 49 Write your solution (computations) in the next tab (on the right) Use this Solution format below, write your solution in "2- Solution (Graded Tab)" on the right Note: Each description, heading and value in your solution will be awarded 1 point each. Hence, just by copying the descriptions and headings below to your solution, you already get points! HOW IT SHOULD HAVE BEEN DONE - 5. First Second Third Year Gross profit from sales P500,000 P700,000 P850,000 P990,000 Operating expenses 200,000 280,000 340,000 396,000 Taxable income P300,000 P420,000 P510,000 P594,000 MCIT at 1% P 50,000 P 7,000 P 8.500 P 99,000 RT at 25% P 75,000 P105,000 P127 500 P148,500 Whichever is higher (ALL RT ) P 75,000 P105,000 P127,500 P148,500 Less: Income tax paid - First quarter ( 75,000) ( 75,000) ( 75,000) Second quarter ( 30,000) ( 30,000) Third quarter 22,500) Due P 75,000 P 30,000 P 22,500 P 21.000 9 11=49 Income Tax Law and Accounting 2-27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts