Question: This task has the CFO asking your team to look at how the market value of BEB is compared to the industry. You need to

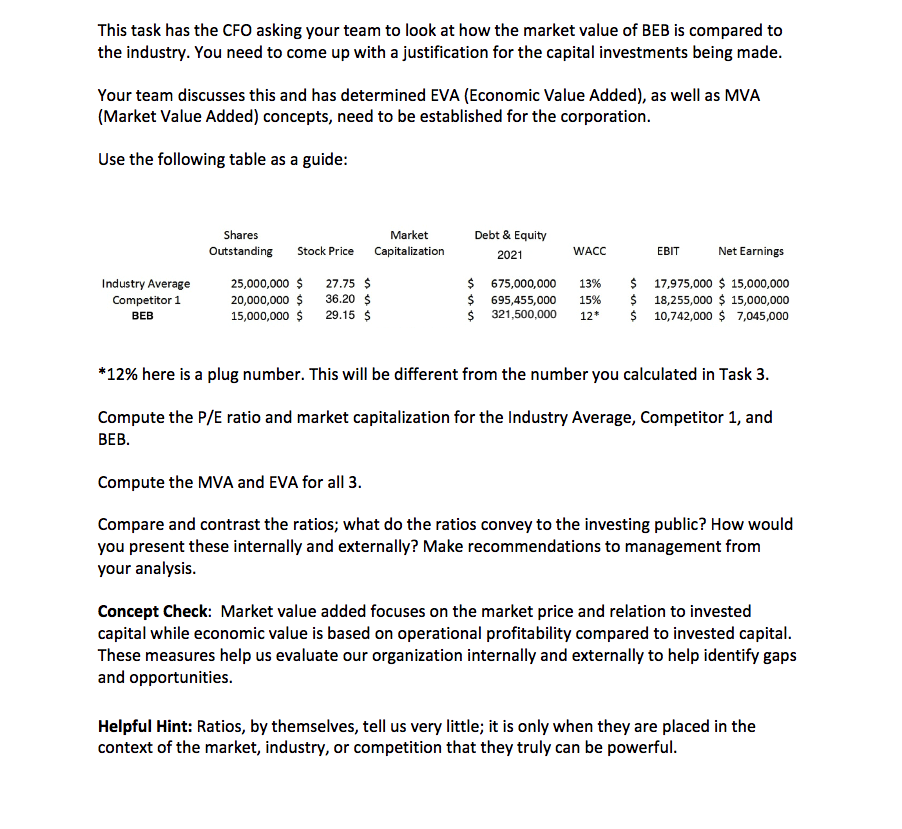

This task has the CFO asking your team to look at how the market value of BEB is compared to the industry. You need to come up with a justification for the capital investments being made. Your team discusses this and has determined EVA (Economic Value Added), as well as MVA (Market Value Added) concepts, need to be established for the corporation. Use the following table as a guide: 12% here is a plug number. This will be different from the number you calculated in Task 3. Compute the P/E ratio and market capitalization for the Industry Average, Competitor 1 , and BEB. Compute the MVA and EVA for all 3. Compare and contrast the ratios; what do the ratios convey to the investing public? How would you present these internally and externally? Make recommendations to management from your analysis. Concept Check: Market value added focuses on the market price and relation to invested capital while economic value is based on operational profitability compared to invested capital. These measures help us evaluate our organization internally and externally to help identify gaps and opportunities. Helpful Hint: Ratios, by themselves, tell us very little; it is only when they are placed in the context of the market, industry, or competition that they truly can be powerful. This task has the CFO asking your team to look at how the market value of BEB is compared to the industry. You need to come up with a justification for the capital investments being made. Your team discusses this and has determined EVA (Economic Value Added), as well as MVA (Market Value Added) concepts, need to be established for the corporation. Use the following table as a guide: 12% here is a plug number. This will be different from the number you calculated in Task 3. Compute the P/E ratio and market capitalization for the Industry Average, Competitor 1 , and BEB. Compute the MVA and EVA for all 3. Compare and contrast the ratios; what do the ratios convey to the investing public? How would you present these internally and externally? Make recommendations to management from your analysis. Concept Check: Market value added focuses on the market price and relation to invested capital while economic value is based on operational profitability compared to invested capital. These measures help us evaluate our organization internally and externally to help identify gaps and opportunities. Helpful Hint: Ratios, by themselves, tell us very little; it is only when they are placed in the context of the market, industry, or competition that they truly can be powerful

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts