Question: This task has the CFO asking your team to look at how the market value of BEB is compared to the industry. You need to

This task has the CFO asking your team to look at how the market value of BEB is compared to the industry. You need to come up with a justification for the capital investments being made.

Your team discusses this and has determined EVA (Economic Value Added), as well as MVA (Market Value Added) concepts, need to be established for the corporation.

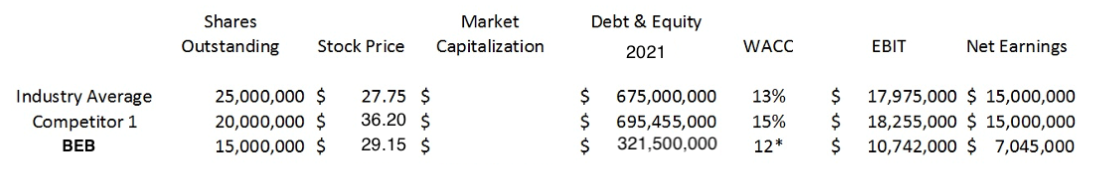

Use the following table as a guide:

*12% here is a plug number.

Compute the MVA and EVA for all 3.

Debt & Equity Shares Outstanding Market Capitalization Stock Price 2021 WACC EBIT Net Earnings Industry Average Competitor 1 25,000,000 $ 20,000,000 $ 15,000,000 $ 27.75 $ 36.20 $ 29.15 $ $ $ $ 675,000,000 695,455,000 321,500,000 13% 15% 12* $ $ $ 17,975,000 $ 15,000,000 18,255,000 $ 15,000,000 10,742,000 $ 7,045,000 BEB

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts