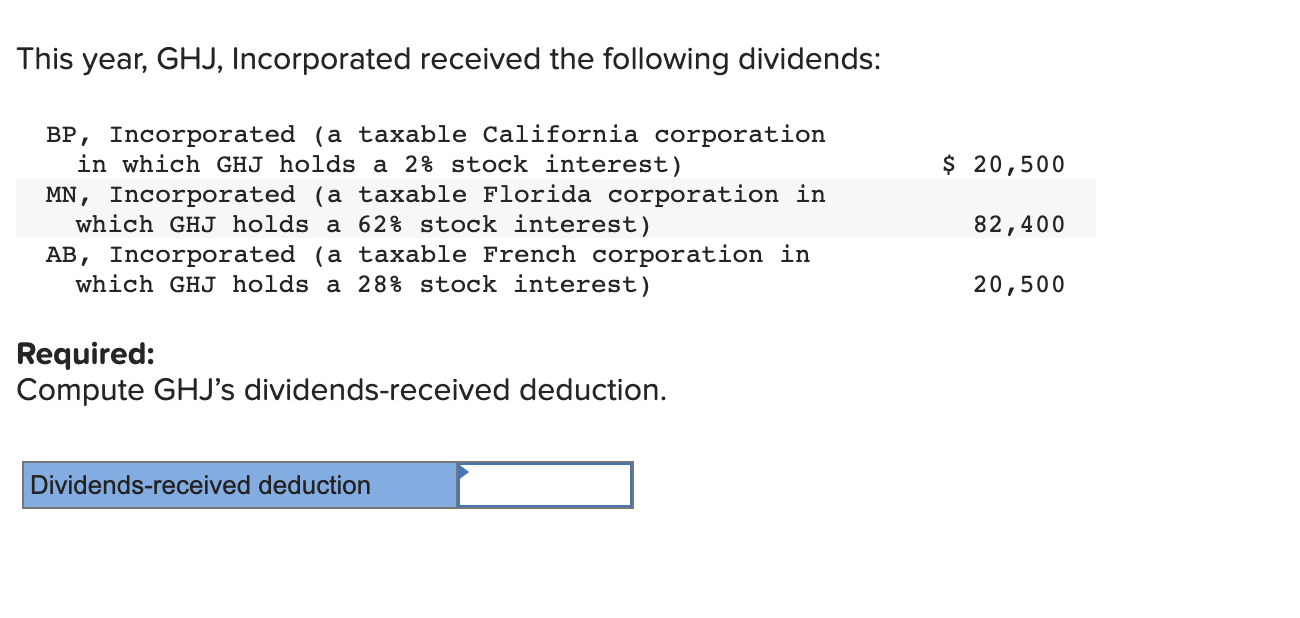

Question: This year, GHJ, Incorporated received the following dividends: ( begin{array}{ll}text { BP, Incorporated (a taxable California corporation } & text { in which GHJ

This year, GHJ, Incorporated received the following dividends: \\( \\begin{array}{ll}\\text { BP, Incorporated (a taxable California corporation } & \\\\ \\text { in which GHJ holds a 2\\% stock interest) } & \\$ 20,500 \\\\ \\text { MN , Incorporated (a taxable Florida corporation in } & \\\\ \\text { which GHJ holds a 62\\% stock interest) } & 82,400 \\\\ \\text { AB, Incorporated (a taxable French corporation in } & \\\\ \\quad \\text { which GHJ holds a } 28 \\% \\text { stock interest) } & 20,500\\end{array} \\) BP, Incorporated (a taxable California corporation in which GHJ holds a \2 stock interest) MN, Incorporated (a taxable Florida corporation in which GHJ holds a \62 stock interest) \\( A B \\), Incorporated (a taxable French corporation in which GHJ holds a \28 stock interest) \\( \\$ 20,500 \\) 82,400 20,500 Required: Compute GHJ's dividends-received deduction. Dividends-received deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts