Question: Three European call options with the same expiry date on the same stock, have strike prices of $22, $23, and $24, respectively. The prices of

Three European call options with the same expiry date on the same stock, have strike prices of $22, $23, and $24, respectively. The prices of the call options are $2.60, $2.10, and $1.90, respectively. One call option gives the holder the right to buy one share. You expect stock price to be stable around the current stock price of $23. Construct a butterfly strategy using the call options quoted to capitalize on your expectation. Present your strategy with a profit diagram and a payoff table. Identify two breakeven stock prices, the minimum and maximum profits of the strategy at the expiration of the options.

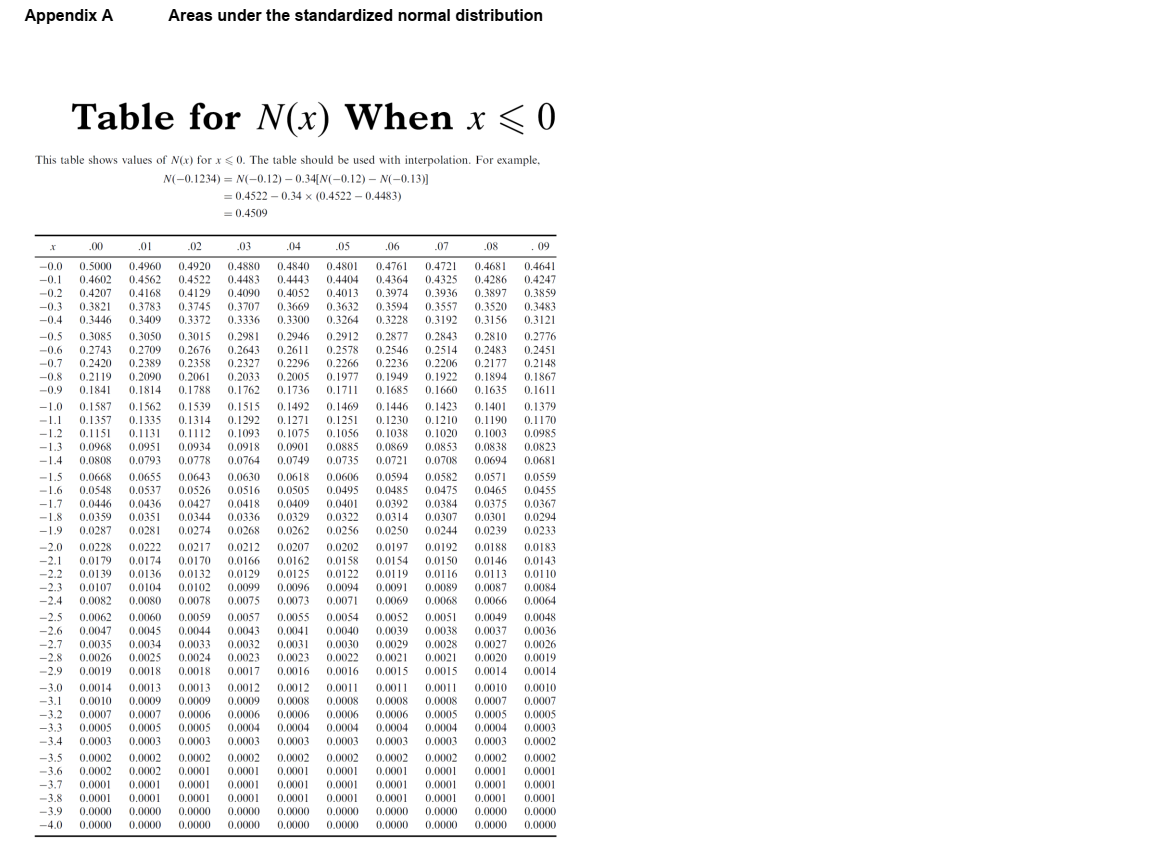

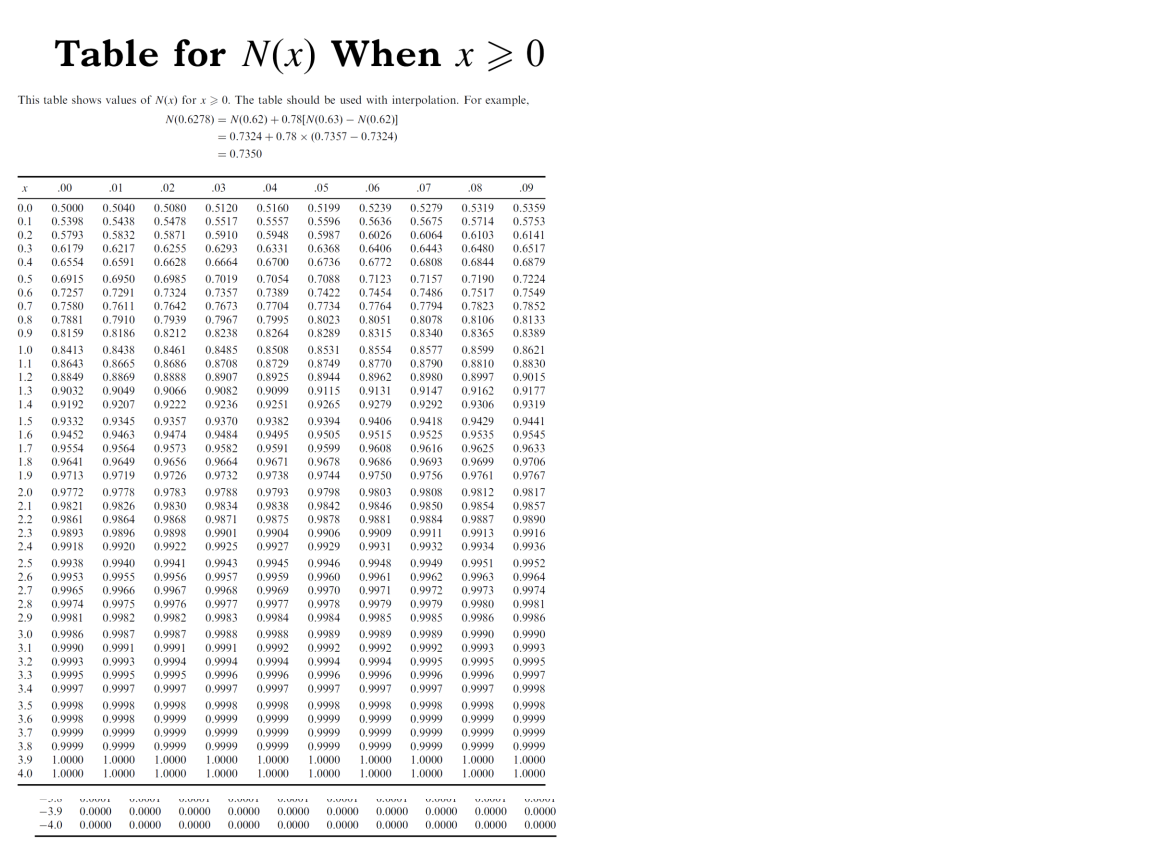

Appendix A Areas under the standardized normal distribution Table for N(x) When x < 0 This table shows values of N(x) for x

Step by Step Solution

There are 3 Steps involved in it

Butterfly Call Spread Strategy Buy 1 call option with strik... View full answer

Get step-by-step solutions from verified subject matter experts