Question: three questions. please dont copy another someone else answer from chegg. Im posting this for a whole new answer. also explain. 1. The balances for

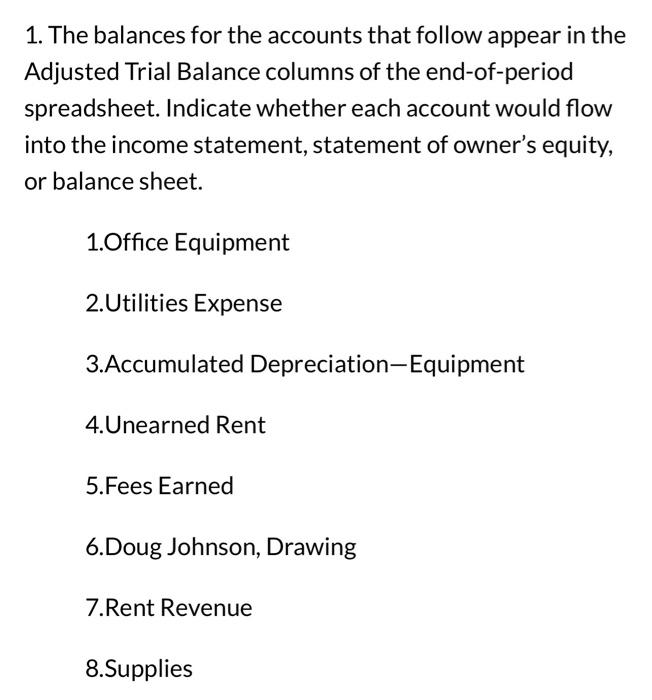

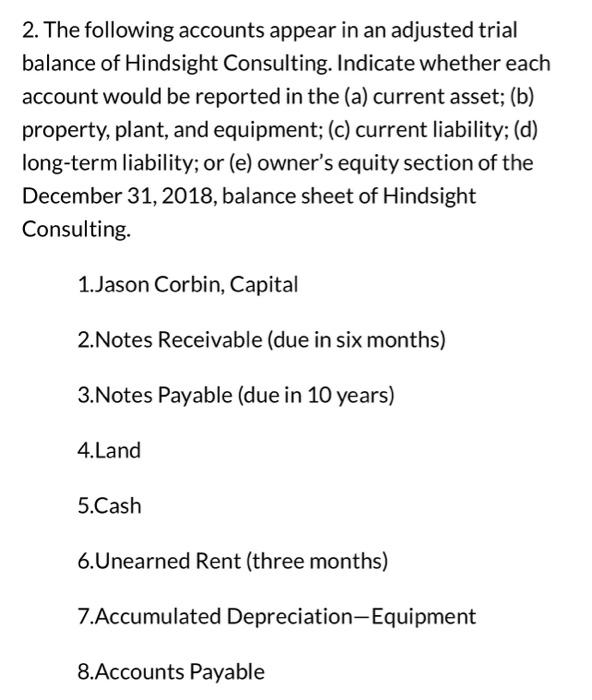

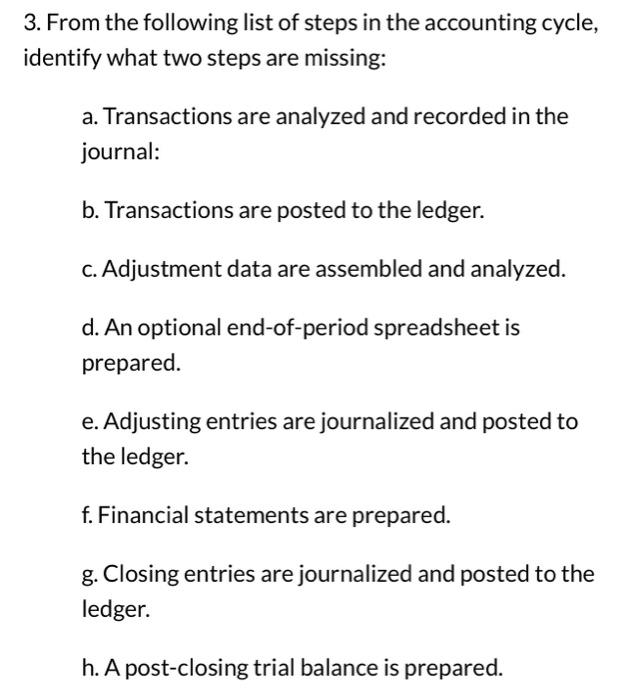

1. The balances for the accounts that follow appear in the Adjusted Trial Balance columns of the end-of-period spreadsheet. Indicate whether each account would flow into the income statement, statement of owner's equity, or balance sheet. 1.Office Equipment 2.Utilities Expense 3.Accumulated Depreciation-Equipment 4.Unearned Rent 5.Fees Earned 6.Doug Johnson, Drawing 7. Rent Revenue 8.Supplies The following accounts appear in an adjusted trial alance of Hindsight Consulting. Indicate whether each ccount would be reported in the (a) current asset; (b) roperty, plant, and equipment; (c) current liability; (d) ng-term liability; or (e) owner's equity section of the ecember 31, 2018, balance sheet of Hindsight onsulting. 1.Jason Corbin, Capital 2. Notes Receivable (due in six months) 3. Notes Payable (due in 10 years) 4. Land 5.Cash 6.Unearned Rent (three months) 7.Accumulated Depreciation-Equipment 8.Accounts Payable rom the following list of steps in the accounting cycle, atify what two steps are missing: a. Transactions are analyzed and recorded in the journal: b. Transactions are posted to the ledger. c. Adjustment data are assembled and analyzed. d. An optional end-of-period spreadsheet is prepared. e. Adjusting entries are journalized and posted to the ledger. f. Financial statements are prepared. g. Closing entries are journalized and posted to the ledger. h. A post-closing trial balance is prepared

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts