Question: thumbs up for a quick detailed answer. (please DO NOT just copy an answer, thumbs down for that) Edit: that's all the teacher provided and

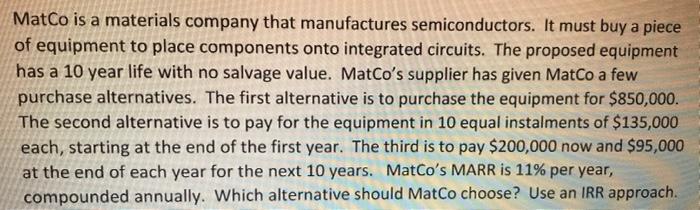

a MatCo is a materials company that manufactures semiconductors. It must buy a piece of equipment to place components onto integrated circuits. The proposed equipment has a 10 year life with no salvage value. MatCo's supplier has given MatCo a few purchase alternatives. The first alternative is to purchase the equipment for $850,000. The second alternative is to pay for the equipment in 10 equal instalments of $135,000 each, starting at the end of the first year. The third is to pay $200,000 now and $95,000 at the end of each year for the next 10 years. MatCo's MARR is 11% per year, compounded annually. Which alternative should MatCo choose? Use an IRR approach

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts