Question: Thx for helping! Problem 6. (10 pts) Consider a European put option written on an underlying S with maturity a half year (T = 1/2)

Thx for helping!

Thx for helping!

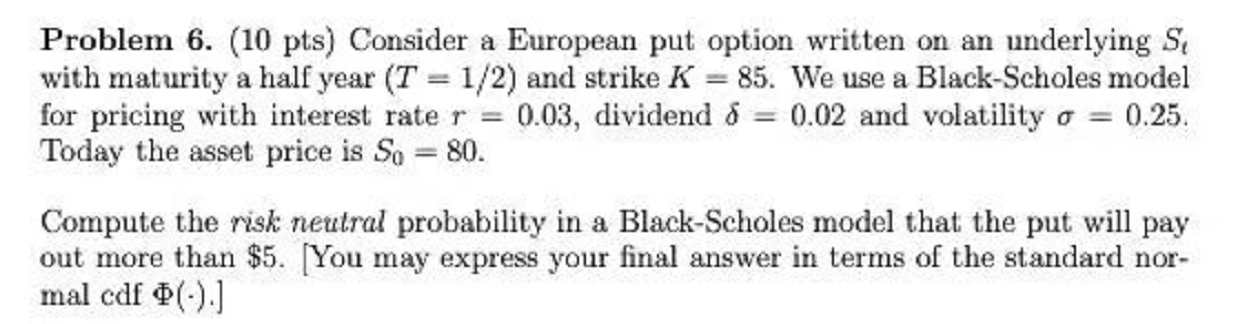

Problem 6. (10 pts) Consider a European put option written on an underlying S with maturity a half year (T = 1/2) and strike K = 85. We use a Black-Scholes model for pricing with interest rate r = 0.03, dividend 8 = 0.02 and volatility o = 0.25. Today the asset price is So = 80. Compute the risk neutral probability in a Black-Scholes model that the put will pay out more than $5. [You may express your final answer in terms of the standard nor- mal cdf (-).] Problem 6. (10 pts) Consider a European put option written on an underlying S with maturity a half year (T = 1/2) and strike K = 85. We use a Black-Scholes model for pricing with interest rate r = 0.03, dividend 8 = 0.02 and volatility o = 0.25. Today the asset price is So = 80. Compute the risk neutral probability in a Black-Scholes model that the put will pay out more than $5. [You may express your final answer in terms of the standard nor- mal cdf (-).]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts