Question: To hedge a foreign currency payable: To hedge a foreign currency payable: sell call options on the foreign currency. buy put options on the foreign

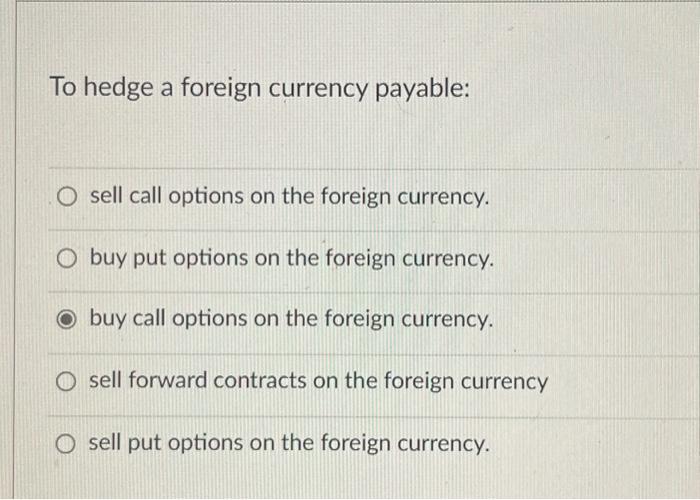

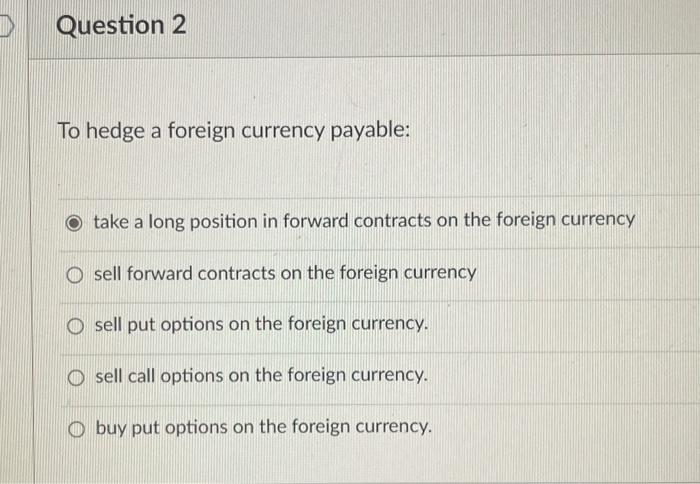

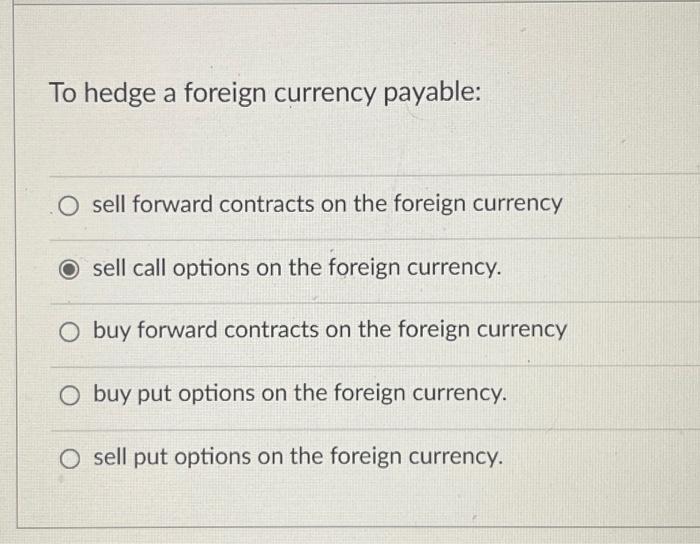

To hedge a foreign currency payable: sell call options on the foreign currency. buy put options on the foreign currency. buy call options on the foreign currency. sell forward contracts on the foreign currenc sell put options on the foreign currency. To hedge a foreign currency payable: take a long position in forward contracts on the foreign currency sell forward contracts on the foreign currency sell put options on the foreign currency. sell call options on the foreign currency. buy put options on the foreign currency. To hedge a foreign currency payable: sell forward contracts on the foreign currency sell call options on the foreign currency. buy forward contracts on the foreign currency buy put options on the foreign currency. sell put options on the foreign currency

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts