Question: Topic: Partnership need solutions please Answers: 1.C 2.C 3.(1)B (2)A(3)B 4.B Problem 1. A, B and C are partners in a business being liquidated. The

Topic: Partnership

need solutions please

Answers: 1.C 2.C 3.(1)B (2)A(3)B 4.B

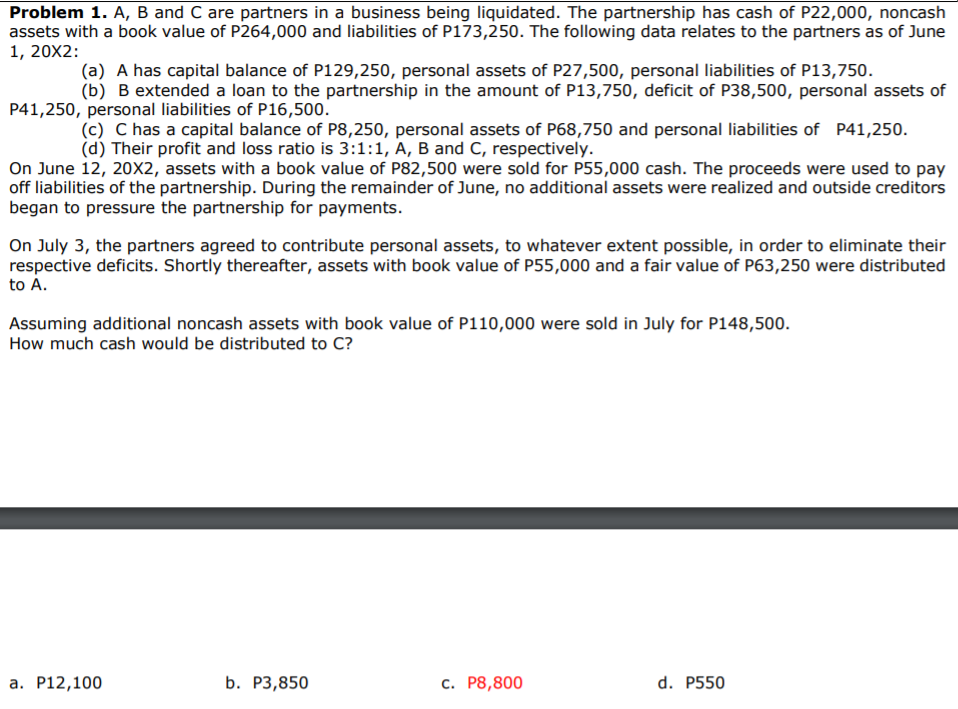

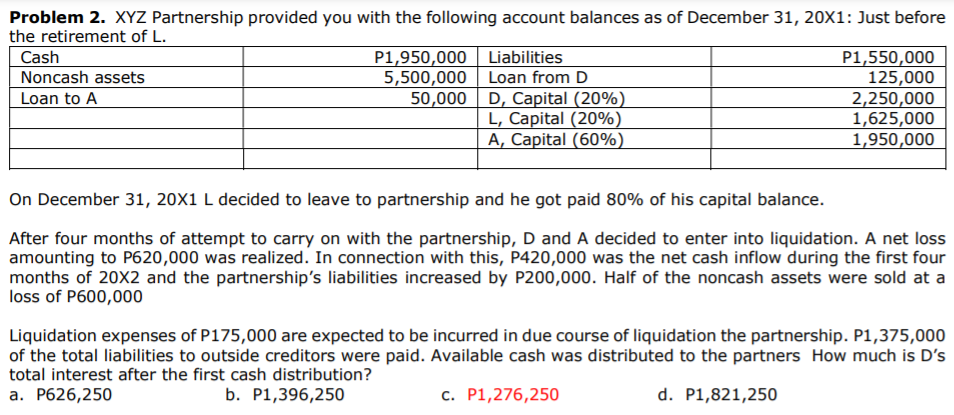

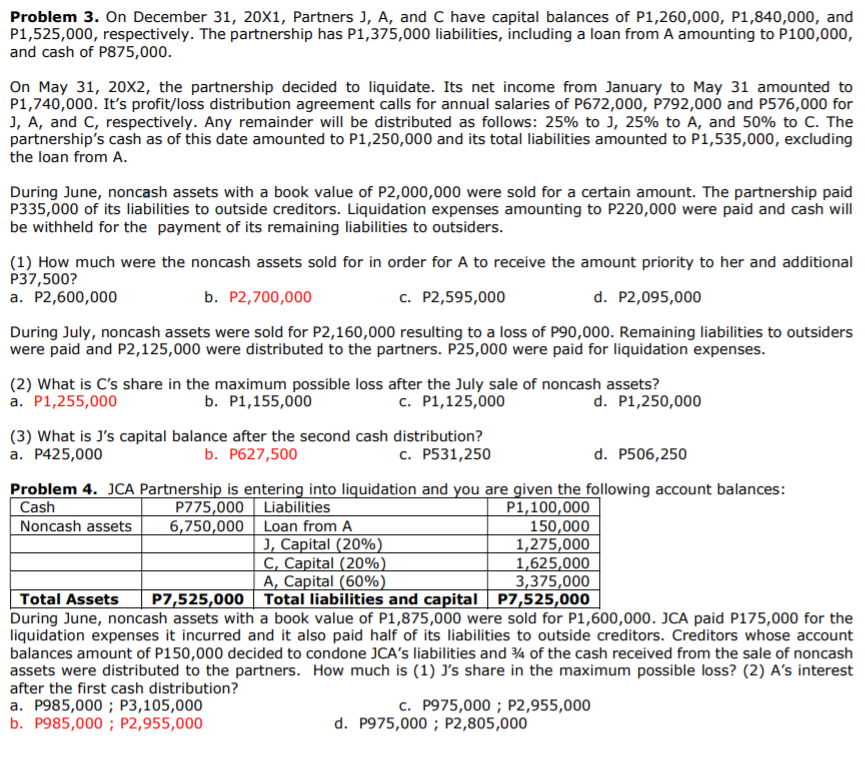

Problem 1. A, B and C are partners in a business being liquidated. The partnership has cash of P22,000, noncash assets with a book value of P264,000 and liabilities of P173,250. The following data relates to the partners as of June 1, 20X2: (a) A has capital balance of P129,250, personal assets of P27,500, personal liabilities of P13,750. (b) B extended a loan to the partnership in the amount of P13,750, deficit of P38,500, personal assets of P41,250, personal liabilities of P16,500. (c) C has a capital balance of P8,250, personal assets of P68,750 and personal liabilities of P41,250. (d) Their profit and loss ratio is 3:1:1, A, B and C, respectively. On June 12, 20X2, assets with a book value of P82,500 were sold for P55,000 cash. The proceeds were used to pay off liabilities of the partnership. During the remainder of June, no additional assets were realized and outside creditors began to pressure the partnership for payments. On July 3, the partners agreed to contribute personal assets, to whatever extent possible, in order to eliminate their respective deficits. Shortly thereafter, assets with book value of P55,000 and a fair value of P63,250 were distributed to A. Assuming additional noncash assets with book value of P110,000 were sold in July for P148,500. How much cash would be distributed to C? a. P12,100 b. P3,850 C. P8,800 d. P550Problem 2. XYZ Partnership provided you with the following account balances as of December 31, 20X1: Just before the retirement of L. Cash P1,950,000 Liabilities P1,550,000 Noncash assets 5,500,000 Loan from D 125,000 Loan to A 50,000 D, Capital (20%} 2,250,000 L, Capital (20%) 1,525,000 A, Capital (60%) 1,950,000 On December 31, 20x1 L decided to leave to partnership and he got paid 80% of his capital balance. After four months of attempt to carry on with the partnership, D and A decided to enter into liquidation. A net loss amounting to P620,000 was realized. In connection with this, P420,000 was the net cash inow during the rst four months of 20x2 and the partnership's liabilities increased by P200,000. Half of the noncash assets were sold at a loss of P600,000 Liquidation expenses of P175,000 are expected to be incurred in due course of liquidation the partnership. P1,375,000 of the total liabilities to outside creditors were paid. Available cash was distributed to the partners How much is D's total interest after the rst cash distribution? a. P626250 b. P1,396,250 (2. 91,276,250 d. P1,821,250 Problem 3. On December 31, 20X1, Partners ], A, and C have capital balances of P1,260,000, P1,840,000, and P1,525,000, respectively. The partnership has P1,375,000 liabilities, including a loan from A amounting to P100,000, and cash of P875,000. On May 31, 20X2, the partnership decided to liquidate. Its net income from January to May 31 amounted to P1,740,000. It's profit/loss distribution agreement calls for annual salaries of P672,000, P792,000 and P576,000 for J, A, and C, respectively. Any remainder will be distributed as follows: 25% to ], 25% to A, and 50% to C. The partnership's cash as of this date amounted to P1,250,000 and its total liabilities amounted to P1,535,000, excluding the loan from A. During June, noncash assets with a book value of P2,000,000 were sold for a certain amount. The partnership paid P335,000 of its liabilities to outside creditors. Liquidation expenses amounting to P220,000 were paid and cash will be withheld for the payment of its remaining liabilities to outsiders. (1) How much were the noncash assets sold for in order for A to receive the amount priority to her and additional P37,500? a. P2,600,000 b. P2,700,000 c. P2,595,000 d. P2,095,000 During July, noncash assets were sold for P2,160,000 resulting to a loss of P90,000. Remaining liabilities to outsiders were paid and P2,125,000 were distributed to the partners. P25,000 were paid for liquidation expenses. (2) What is C's share in the maximum possible loss after the July sale of noncash assets? a. P1,255,000 b. P1, 155,000 c. P1, 125,000 d. P1,250,000 (3) What is J's capital balance after the second cash distribution? a. P425,000 b. P627,500 c. P531,250 d. P506,250 Problem 4. JCA Partnership is entering into liquidation and you are given the following account balances: Cash P775,000 Liabilities P1,100,000 Noncash assets 6,750,000 Loan from A 150,000 J, Capital (20%) 1,275,000 C, Capital (20% 1,625,000 A, Capital (60%) 3,375,000 Total Assets P7,525,000 Total liabilities and capital |P7,525,000 During June, noncash assets with a book value of P1,875,000 were sold for P1,600,000. JCA paid P175,000 for the liquidation expenses it incurred and it also paid half of its liabilities to outside creditors. Creditors whose account balances amount of P150,000 decided to condone JCA's liabilities and 3% of the cash received from the sale of noncash assets were distributed to the partners. How much is (1) J's share in the maximum possible loss? (2) A's interest after the first cash distribution? a. P985,000 ; P3,105,000 c. P975,000 ; P2,955,000 b. P985,000 ; P2,955,000 d. P975,000 ; P2,805,000