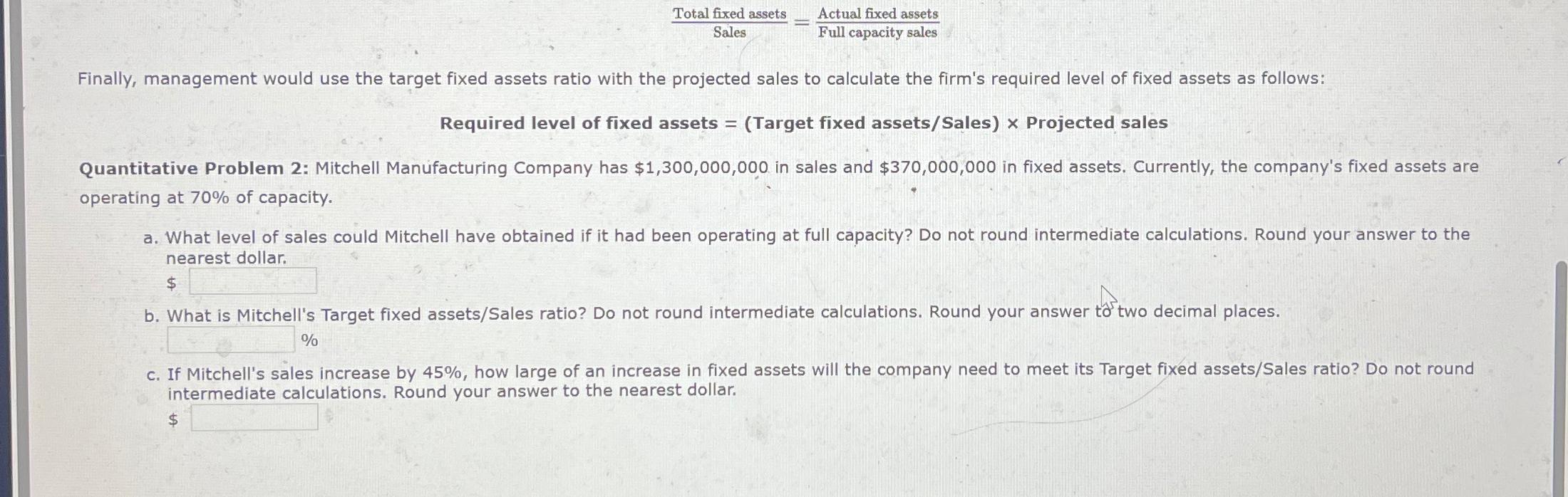

Question: Total fixed assets Sales Actual fixed assets Full capacity sales Finally, management would use the target fixed assets ratio with the projected sales to

Total fixed assets Sales Actual fixed assets Full capacity sales Finally, management would use the target fixed assets ratio with the projected sales to calculate the firm's required level of fixed assets as follows: Required level of fixed assets = (Target fixed assets/Sales) x Projected sales Quantitative Problem 2: Mitchell Manufacturing Company has $1,300,000,000 in sales and $370,000,000 in fixed assets. Currently, the company's fixed assets are operating at 70% of capacity. a. What level of sales could Mitchell have obtained if it had been operating at full capacity? Do not round intermediate calculations. Round your answer to the nearest dollar. $ b. What is Mitchell's Target fixed assets/Sales ratio? Do not round intermediate calculations. Round your answer to two decimal places. % c. If Mitchell's sales increase by 45%, how large of an increase in fixed assets will the company need to meet its Target fixed assets/Sales ratio? Do not round intermediate calculations. Round your answer to the nearest dollar. $

Step by Step Solution

3.33 Rating (171 Votes )

There are 3 Steps involved in it

a To find the level of sales Mitchell could have obtained if it had been operating at full capacity ... View full answer

Get step-by-step solutions from verified subject matter experts