Question: Transactions for April 2 0 2 4 A B C D E F G H 2 3 4 5 6 7 8 9 1 0

Transactions for April A

B

C

D

E

F

G

H

HINTS

Use the numeric values from the table of transactions in Transactions worksheet for calculations to joumalize Redmond's transactions for

Do not use an equal sign when entering a numeric value.

Enter debits, then credits.

Enter the journal entries according to the transaction number r #I and date. Some of the input cells marked in blue may not require entries.

Instructions

Transactions

ENTERANSWERS

ENTERANSU

Ready

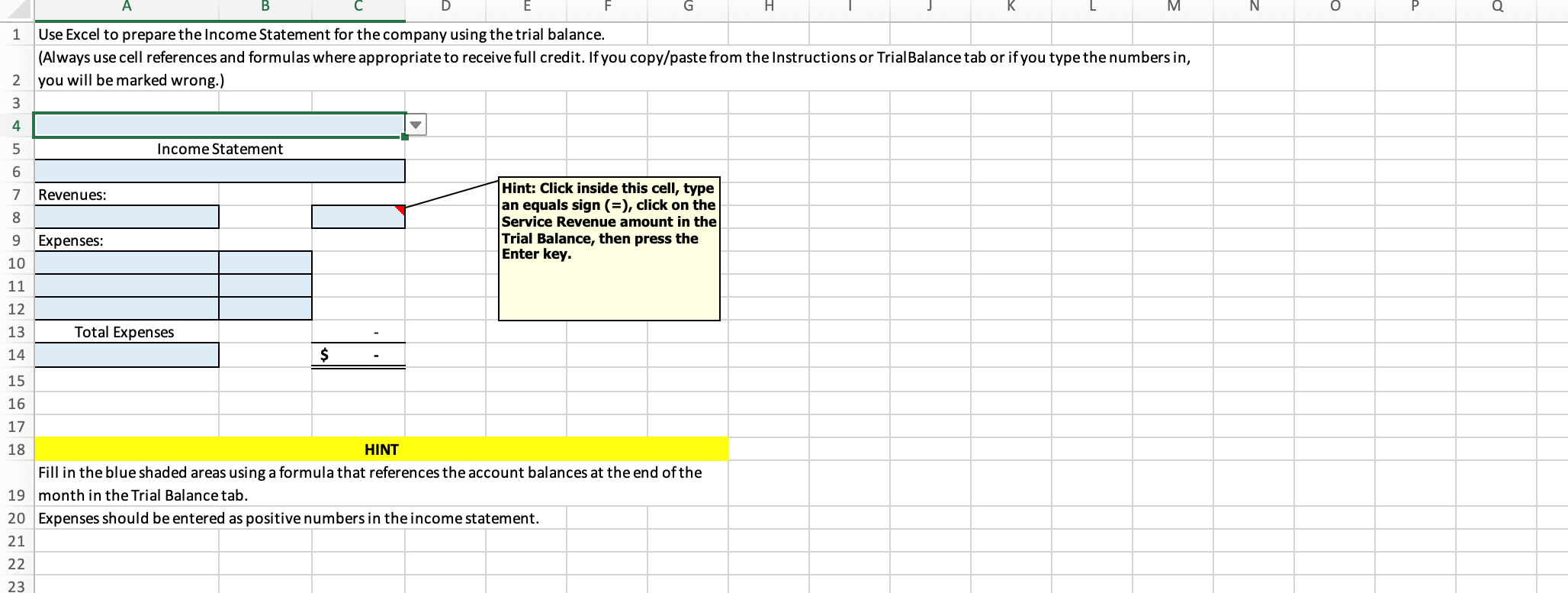

Accessibility: Investigate No answers entered here! The trial balance will automatically populate after the answers are entered in the ENTERANSWER tab.Use Excel to prepare the Income Statement for the company using the trial balance.

Always use cell references and formulas where appropriate to receive full credit. If you copypaste from the Instructions or Trial Balance tab or if you type the numbers in

you will be marked wrong.

Hint: Click inside this cell, type

an equals sign click on the

Service Revenue amount in the

Trial Balance, then press the

Enter key.

Fill in the blue shaded areas using a formula that references the account balances at the end of the

month in the Trial Balance tab.

Expenses should be entered as positive numbers in the income statement.

On April Redmond Corporation, an information technology IT consulting company, received $ cash from Ron Larson, and the business issued common

stock to him.

On April Redmond paid $ cash for land.

Redmond purchased $ of office supplies on account on April

On April Redmond provided IT consulting services for a client and collected $ cash.

Redmond provided IT consulting services of $ for clients on April The clients will pay Redmond in the future.

Redmond paid cash expenses on April : salaries of $ and office rent of $

On April Redmond paid $ on the accounts payable created in Transaction #

Redmond collected $ cash on April from a client in transaction #

On April Redmond paid $ for dividends.

On April Redmond prepaid office rent of $ for the months of May, June and July.

Redmond paid $ salaries to employees on April

Redmond purchased a building for $ on April A note payable was issued for the entire amount.

On April Redmond received a contribution of furniture with a fair market value of $ from Ron Larson, who received common stock in exchange.

Redmond received a cell phone bill for $ on April and will pay this amount in May. Use Utilities Payable.

On April Redmond paid employee salaries of $

Redmond meets with a client on April who pays $ in advance for consulting services to be performed during May and June.

On April Redmond performed consulting services for clients and received $ in cash.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock