Question: 21. is the risk that the value of a cash flow in one currency. when translated from another currency, will decline due to a change

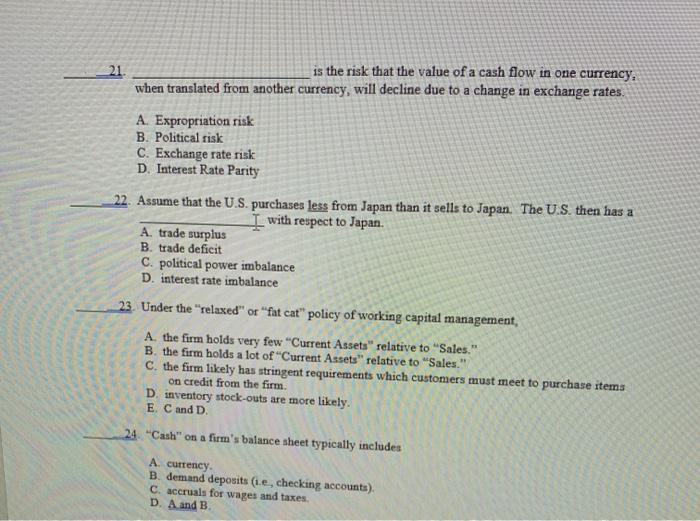

21. is the risk that the value of a cash flow in one currency. when translated from another currency, will decline due to a change in exchange rates. A. Expropriation risk B. Political risk C. Exchange rate risk D. Interest Rate Parity 22. Assume that the U.S. purchases less from Japan than it sells to Japan. The U.S. then has a I with respect to Japan. A. trade surplus B. trade deficit C. political power imbalance D. interest rate imbalance 23. Under the "relaxed" or "fat cat" policy of working capital management, A. the firm holds very few "Current Assets" relative to "Sales." B. the firm holds a lot of "Current Assets" relative to "Sales. C. the firm likely has stringent requirements which customers must meet to purchase items on credit from the firm. D. inventory stock-outs are more likely. E C and D 24. "Cash" on a firm's balance sheet typically includes A currency B. demand deposits (ie, checking accounts) C. accruals for wages and taxes D. A and B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts