Question: Henry Co. wants to evaluate the possibility of introducing a new product into the market. Based on the following information, help Henry Co. in estimating

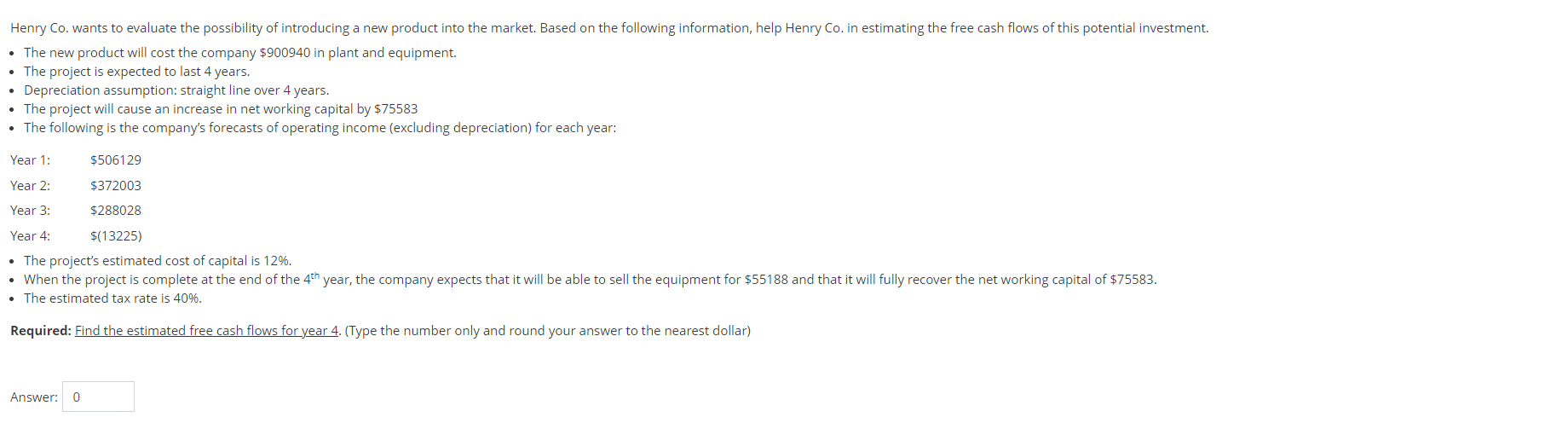

Henry Co. wants to evaluate the possibility of introducing a new product into the market. Based on the following information, help Henry Co. in estimating the free cash flows of this potential investment. The new product will cost the company $900940 in plant and equipment. The project is expected to last 4 years. Depreciation assumption: straight line over 4 years. The project will cause an increase in net working capital by $75583 The following is the company's forecasts of operating income (excluding depreciation) for each year: Year 1: $506129 Year 2: $372003 Year 3: $288028 Year 4: $(13225) The project's estimated cost of capital is 12%. When the project is complete at the end of the 4th year, the company expects that it will be able to sell the equipment for $55188 and that it will fully recover the net working capital of $75583. The estimated tax rate is 40%. Required: Find the estimated free cash flows for year 4. (Type the number only and round your answer to the nearest dollar) Answer: 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts