Question: Problem 6-49 (LO 6-3) Walt purchased a large screen for video conferences for $3,600. He could use the screen exclusively for his business, or he

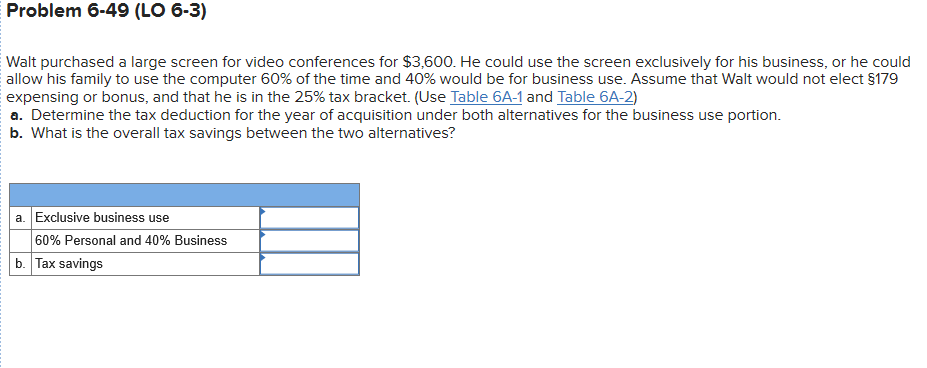

Problem 6-49 (LO 6-3) Walt purchased a large screen for video conferences for $3,600. He could use the screen exclusively for his business, or he could allow his family to use the computer 60% of the time and 40% would be for business use. Assume that Walt would not elect $179 expensing or bonus, and that he is in the 25% tax bracket. (Use Table 6A-1 and Table 6A-2) a. Determine the tax deduction for the year of acquisition under both alternatives for the business use portion. b. What is the overall tax savings between the two alternatives? a. Exclusive business use 60% Personal and 40% Business b. Tax savings Problem 6-49 (LO 6-3) Walt purchased a large screen for video conferences for $3,600. He could use the screen exclusively for his business, or he could allow his family to use the computer 60% of the time and 40% would be for business use. Assume that Walt would not elect $179 expensing or bonus, and that he is in the 25% tax bracket. (Use Table 6A-1 and Table 6A-2) a. Determine the tax deduction for the year of acquisition under both alternatives for the business use portion. b. What is the overall tax savings between the two alternatives? a. Exclusive business use 60% Personal and 40% Business b. Tax savings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts