Question: QUESTION 70 You're the purchasing manager for a large trucking company, womed about a spike in oil prices come January 15 when you typically buy

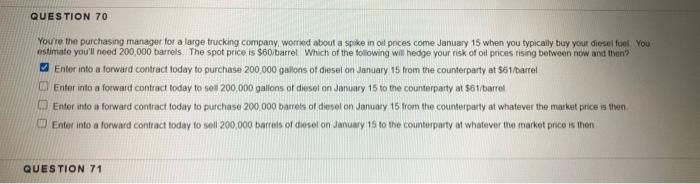

QUESTION 70 You're the purchasing manager for a large trucking company, womed about a spike in oil prices come January 15 when you typically buy your diesel fuel You estimate you'll need 200,000 barrels. The spot price is $60 barrel Which of the following will hedge your risk of oil prices rising between now and then Enter into a forward contract today to purchase 200 000 gallons of diesel on January 15 from the counterparty at $61/bartel Enter into a forward contract today to sell 200,000 gallons of diesel on January 15 to the counterparty at $51/barrel Enter into a forward contract today to purchase 200,000 barrels of diesel on January 15 from the counterparty at whatever the market price is the Enter into a forward contract today to sell 200,000 barrels of diesel on January 15 to the counterparty at whatever the market price is then QUESTION 71

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts