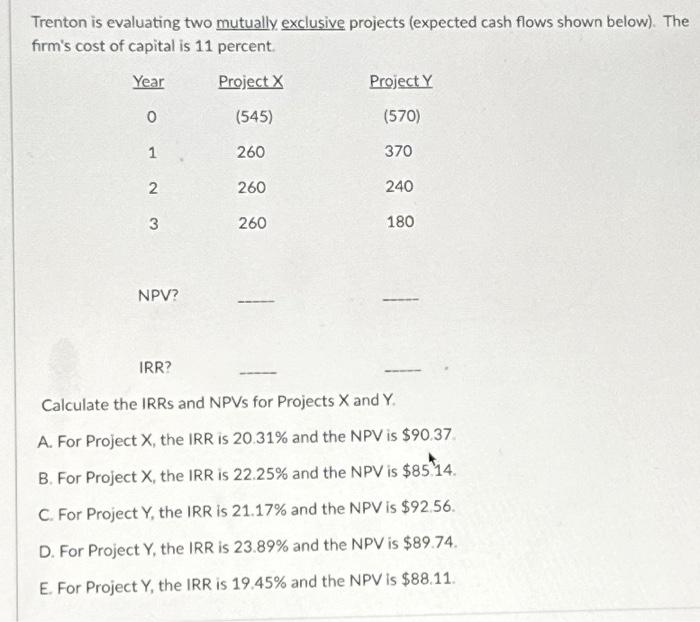

Question: Trenton is evaluating two mutually exclusive projects (expected cash flows shown below). The firm's cost of capital is 11 percent. Year Project X (545) 260

Trenton is evaluating two mutually exclusive projects (expected cash flows shown below). The frrm's cost of capital is 11 percent. Calculate the IRRs and NPVs for Projects X and Y. A. For Project X, the IRR is 20.31% and the NPV is $90.37 B. For Project X, the IRR is 22.25% and the NPV is $8514 C. For Project Y, the IRR is 21.17% and the NPV is $92.56. D. For Project Y, the IRR is 23.89% and the NPV is $89.74. E. For Project Y, the IRR is 19.45% and the NPV is $88.11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts