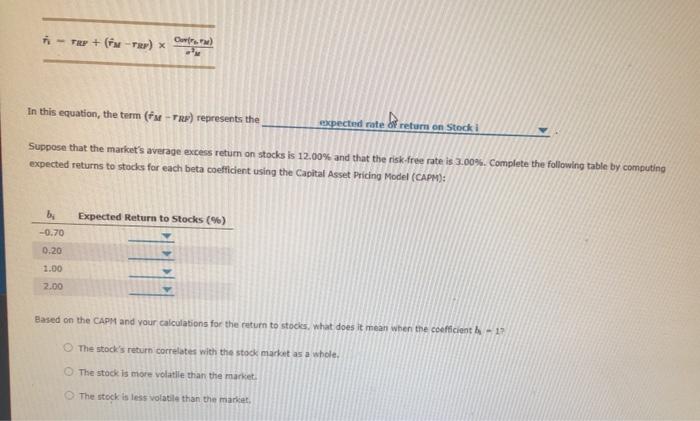

Question: - TRP+ Tap) In this equation, the term (** -TRP) represents the expected rate di return on Stocki Suppose that the market's average excess retum

- TRP+ Tap) In this equation, the term (** -TRP) represents the expected rate di return on Stocki Suppose that the market's average excess retum on stocks is 12.00% and that the risk free rate is 3.00%. Complete the following table by computing expected returns to stocks for each beta coefficient using the Capital Asset Pricing Model (CAPM): Expected Return to Stocks (%) bi -0.70 0.20 1.00 2.00 Based on the CAP and your calculations for the return to stocks, what does it mean when the coefficient - 17 The stock's return correlates with the stock market as a whole. The stock is more volatile than the market The stock is less volatile than the market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts