Question: True / False State whether the following statements are true or false. You do NOT need to provide a justification. a ) In the market

TrueFalse

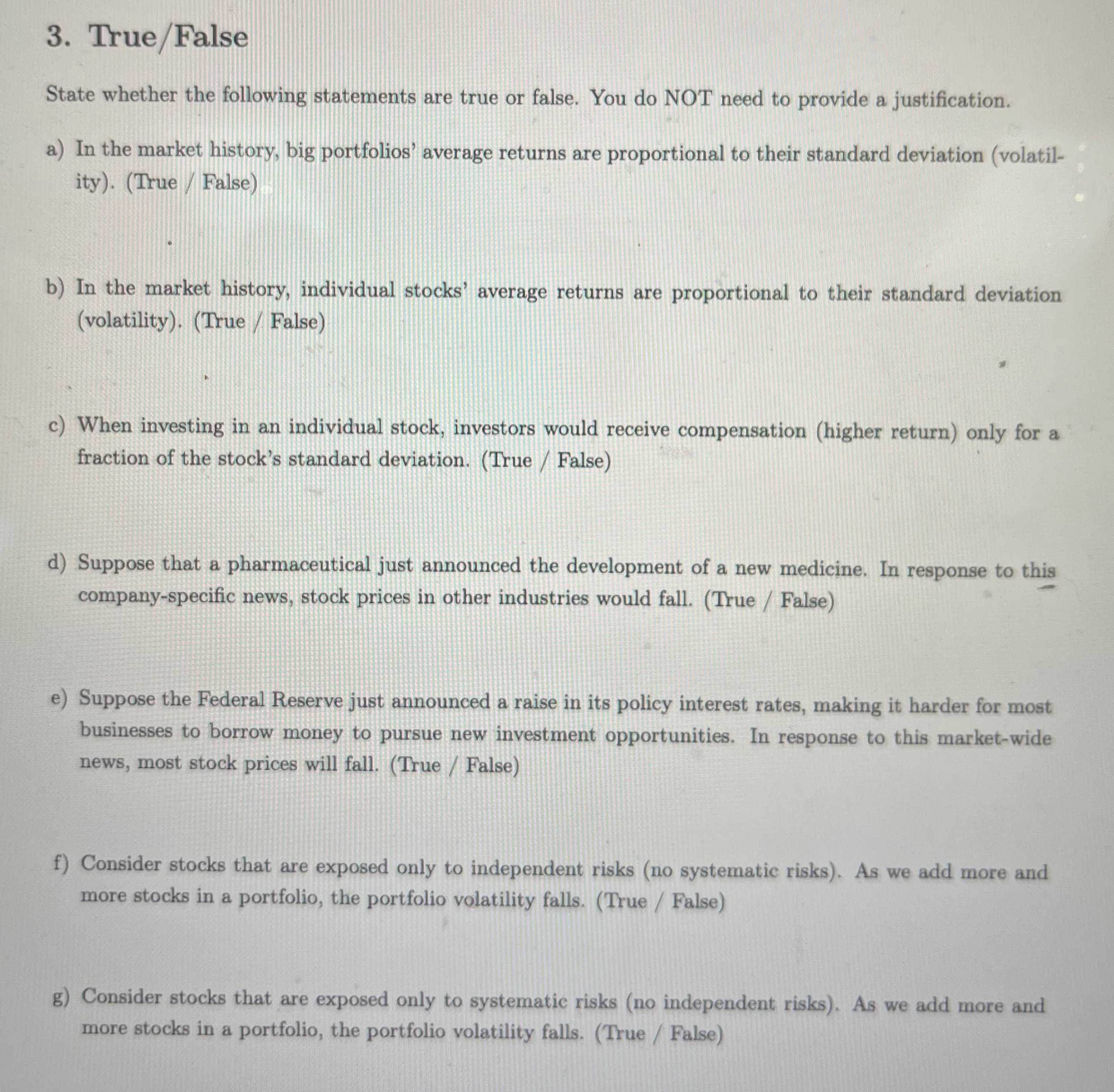

State whether the following statements are true or false. You do NOT need to provide a justification.

a In the market history, big portfolios' average returns are proportional to their standard deviation volatil

ityTrue False

b In the market history, individual stocks' average returns are proportional to their standard deviation

volatilityTrue False

c When investing in an individual stock, investors would receive compensation higher return only for a

fraction of the stock's standard deviation. True False

d Suppose that a pharmaceutical just announced the development of a new medicine. In response to this

companyspecific news, stock prices in other industries would fall. True False

e Suppose the Federal Reserve just announced a raise in its policy interest rates, making it harder for most

businesses to borrow money to pursue new investment opportunities. In response to this marketwide

news, most stock prices will fall. True False

f Consider stocks that are exposed only to independent risks no systematic risks As we add more and

more stocks in a portfolio, the portfolio volatility falls. True False

g Consider stocks that are exposed only to systematic risks no independent risks As we add more and

more stocks in a portfolio, the portfolio volatility falls. True False

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock