Question: True or False 8. The Tax Table Method of computing tax liability must be used by those taxpayers who are eligible to use that method.

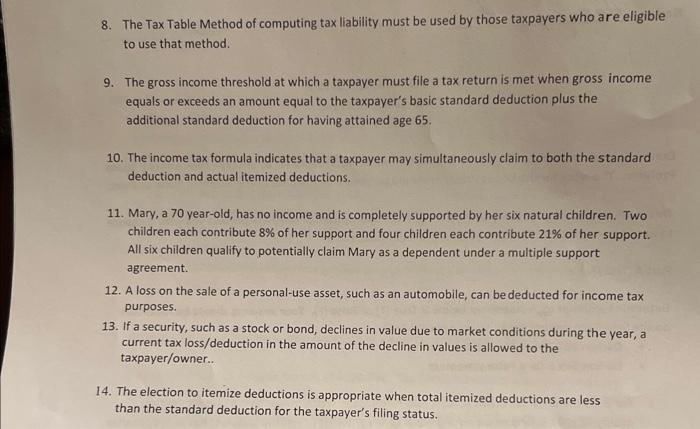

8. The Tax Table Method of computing tax liability must be used by those taxpayers who are eligible to use that method. 9. The gross income threshold at which a taxpayer must file a tax return is met when gross income equals or exceeds an amount equal to the taxpayer's basic standard deduction plus the additional standard deduction for having attained age 65. 10. The income tax formula indicates that a taxpayer may simultaneously claim to both the standard deduction and actual itemized deductions. 11. Mary, a 70 year-old, has no income and is completely supported by her six natural children. Two children each contribute 8% of her support and four children each contribute 21% of her support. All six children qualify to potentially claim Mary as a dependent under a multiple support agreement. 12. A loss on the sale of a personal-use asset, such as an automobile, can be deducted for income tax purposes. 13. If a security, such as a stock or bond, declines in value due to market conditions during the year, a current tax loss/deduction in the amount of the decline in values is allowed to the taxpayer/owner.. 14. The election to itemize deductions is appropriate when total itemized deductions are less than the standard deduction for the taxpayer's filing status

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts