Question: trying to complete this practice test from book need help. please answer all even the ones i guessed on. Thanks! documen t used by organizations

trying to complete this practice test from book need help. please answer all even the ones i guessed on. Thanks!

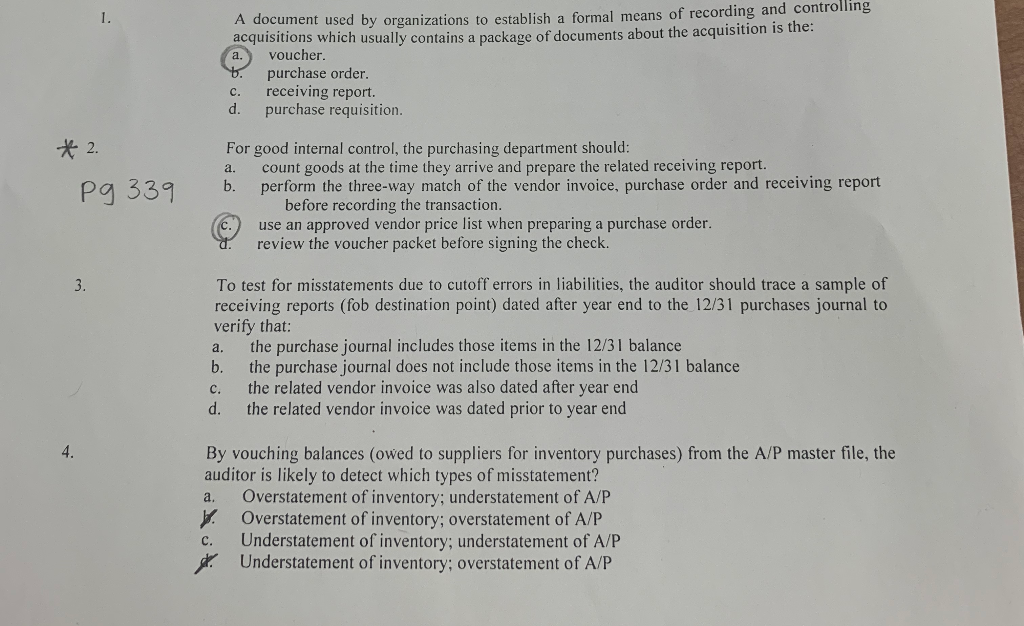

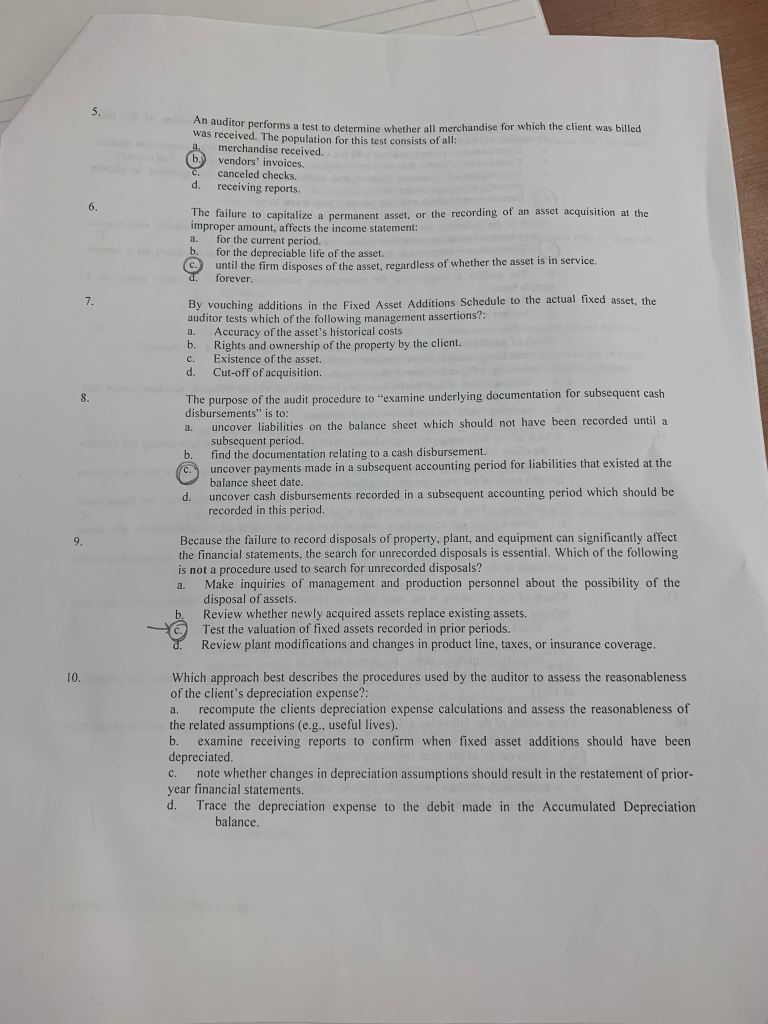

documen t used by organizations to establish a formal means of recording and controlling acquisitions which usually contains a package of documents about the acquisition is the: a. voucher purchase order. C. receiving report d. purchase requisition. For good internal control, the purchasing department should: count goods at the time they arrive and prepare the related receiving report. a. Pa 339 b. perform the three-way match of the vendor invoice, purchase order and receiving report before recording the transaction. use an approved vendor price list when preparing a purchase order review the voucher packet before signing the check. To test for misstatements due to cutoff errors in liabilities, the auditor should trace a sample of receiving reports (fob destination point) dated after year end to the 12/31 purchases journal to verify that: a. the purchase journal includes those items in the 12/3 1 balance b. the purchase journal does not include those items in the 12/31 balance c. the related vendor invoice was also dated after year end d. the related vendor invoice was dated prior to year end 3 4. By vouching balances (owed to suppliers for inventory purchases) from the A/P master file, the auditor is likely to detect which types of misstatement? a. Overstatement of inventory; understatement of A/F Overstatement of inventory; overstatement of A/P Understatement of inventory; understatement of A/P c. Understatement of inventory; overstatement of A/P An auditor performs a test to determine whether all merchandise for which the client was billed was received. The population for this test consists of alli merchandise received. b. vendors' invoices. canceled checks. d. receiving reports. 6. The failure to capitalize a permanent asset, or the recording of an asset acquisition at the improper amount, affects the income statement: a. for the current period. for the depreciable life of the asset. c. until the tirm disposes of the asset, regardless of whether the asset is in service. forever. By vouching additions in the Fixed Asset Additions Schedule to the actual fixed asset, the auditor tests which of the following management assertions?: a. Accuracy of the asset's historical costs b. Rights and ownership of the property by the client. c. Existence of the asset. d. Cut-off of acquisition. 7. The purpose of the audit procedure to "examine underlying documentation for subsequent cash disbursements" is to uncover liabilities on the balance sheet which should not have been recorded until a subsequent period. find the documentation relating to a cash disbursement uncover payments made in a subsequent accounting period for liabilities that existed at the balance sheet date. uncover cash disbursements recorded in a subsequent accounting period which should be recorded in this period a. b. d. Because the failure to record disposals of property, plant, and equipment can significantly affect the financial statements, the search for unrecorded disposals is essential. Which of the following is not a procedure used to search for unrecorded disposals? Make inquiries of management and production personnel about the possibility of the disposal of assets. Review whether newly acquired assets replace existing assets. Test the valuation of fixed assets recorded in prior periods. Review plant modifications and changes in product line, taxes, or insurance coverage. a. b Which approach best describes the procedures used by the auditor to assess the reasonableness of the client's depreciation expense? a. recompute the clients depreciation expense calculations and assess the reasonableness of the related assumptions (e.g., useful lives). b. examine receiving reports to confirm when fixed asset additions should have been depreciated. c. note whether changes in depreciation assumptions should result in the restatement of prior year financial statements. d. Trace the depreciation expense to the debit made in the Accumulated Depreciation 10. balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts