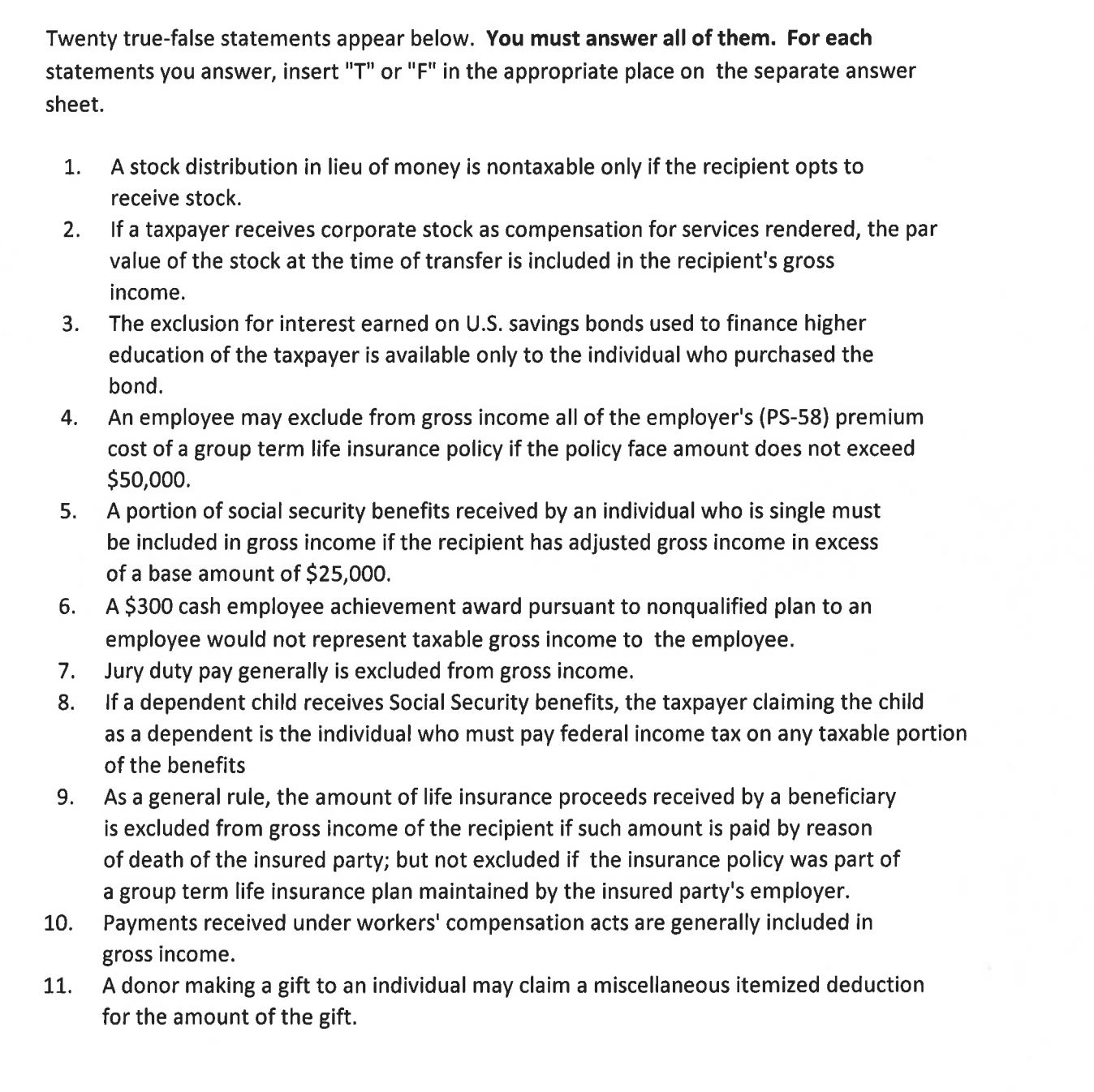

Question: Twenty true - false statements appear below. You must answer all of them. For each statements you answer, insert T or F

Twenty truefalse statements appear below. You must answer all of them. For each statements you answer, insert T or F in the appropriate place on the separate answer sheet.

A stock distribution in lieu of money is nontaxable only if the recipient opts to receive stock.

If a taxpayer receives corporate stock as compensation for services rendered, the par value of the stock at the time of transfer is included in the recipient's gross income.

The exclusion for interest earned on US savings bonds used to finance higher education of the taxpayer is available only to the individual who purchased the bond.

An employee may exclude from gross income all of the employer's PS premium cost of a group term life insurance policy if the policy face amount does not exceed $

A portion of social security benefits received by an individual who is single must be included in gross income if the recipient has adjusted gross income in excess of a base amount of $

A $ cash employee achievement award pursuant to nonqualified plan to an employee would not represent taxable gross income to the employee.

Jury duty pay generally is excluded from gross income.

If a dependent child receives Social Security benefits, the taxpayer claiming the child as a dependent is the individual who must pay federal income tax on any taxable portion of the benefits

As a general rule, the amount of life insurance proceeds received by a beneficiary is excluded from gross income of the recipient if such amount is paid by reason of death of the insured party; but not excluded if the insurance policy was part of a group term life insurance plan maintained by the insured party's employer.

Payments received under workers' compensation acts are generally included in gross income.

A donor making a gift to an individual may claim a miscellaneous itemized deduction for the amount of the gift.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock