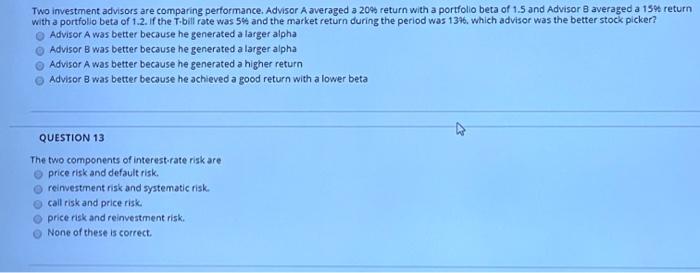

Question: Two investment advisors are comparing performance Advisor A averaged a 20% return with a portfolio beta of 1.5 and Advisor e averaged a 15% return

Two investment advisors are comparing performance Advisor A averaged a 20% return with a portfolio beta of 1.5 and Advisor e averaged a 15% return with a portfolio beta of 1.2. If the T-bill rate was 54 and the market return during the period was 1346. which advisor was the better stock picker? Advisor A was better because he generated a larger alpha Advisor B was better because he generated a larger alpha Advisor A was better because he generated a higher return Advisor 8 was better because he achieved a good return with a lower beta QUESTION 13 The two components of interest rate risk are price risk and default risk, reinvestment risk and systematic risk. call risk and price risk price risk and reinvestment risk. None of these is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts