Question: Two mutually exclusive capital projects are being considered by the chief financial officer ( CFO ) of a small technology compai software initiative. However, the

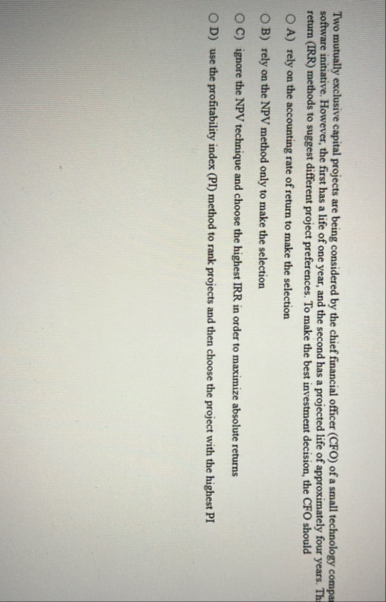

Two mutually exclusive capital projects are being considered by the chief financial officer CFO of a small technology compai software initiative. However, the first has a life of one year, and the second has a projected life of approximately four years. Thi return IRR methods to suggest different project preferences. To make the best investment decision, the CFO should

A rely on the accounting rate of return to make the selection

B rely on the NPV method only to make the selection

C ignore the NPV technique and choose the highest IRR in order to maximize absolute returns

D use the profitability index PI method to rank projects and then choose the project with the highest PI

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock