Question: Two options: a Call and a Put. Call premium = $.022/ Put premium = $.02/ Call option strike price = $ 1.09 / Put option

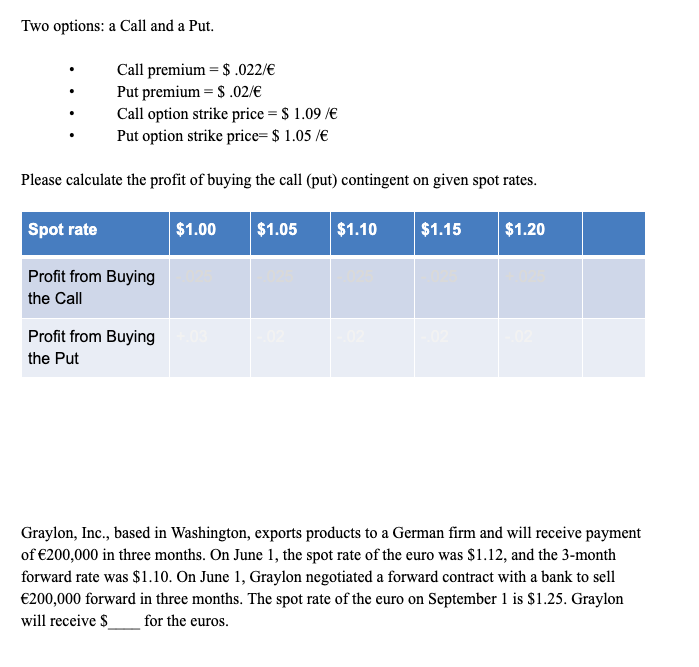

Two options: a Call and a Put. Call premium = $.022/ Put premium = $.02/ Call option strike price = $ 1.09 / Put option strike price= $ 1.05 / Please calculate the profit of buying the call (put) contingent on given spot rates. Spot rate $1.00 $1.05 $1.10 $1.15 $1.20 Profit from Buying the Call Profit from Buying the Put Graylon, Inc., based in Washington, exports products to a German firm and will receive payment of 200,000 in three months. On June 1, the spot rate of the euro was $1.12, and the 3-month forward rate was $1.10. On June 1, Graylon negotiated a forward contract with a bank to sell 200,000 forward in three months. The spot rate of the euro on September 1 is $1.25. Graylon will receive $ for the euros

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts