Question: Two put options on the same underlying, both expiring in 1 month. Put option 1 struck at $50 is priced at $5 while put

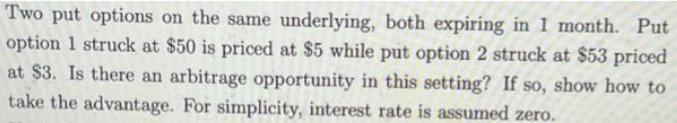

Two put options on the same underlying, both expiring in 1 month. Put option 1 struck at $50 is priced at $5 while put option 2 struck at $53 priced at $3. Is there an arbitrage opportunity in this setting? If so, show how to take the advantage. For simplicity, interest rate is assumed zero.

Step by Step Solution

3.27 Rating (147 Votes )

There are 3 Steps involved in it

Answer Call option is the right to buy the underlying asset at a specif... View full answer

Get step-by-step solutions from verified subject matter experts