Question: Suppose the current time is 0. Consider two European put options on the same underlying stock and the same maturity date T, but with different

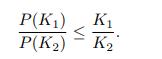

Suppose the current time is 0. Consider two European put options on the same underlying stock and the same maturity date T, but with different strike prices K1 and K2, where K1 ≤ K2. The prices of the above options are denoted by P(K1) and P(K2), respectively.

Use no-arbitrage arguments to show that

P(K) P(K) VI K K

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Certainly The principle of noarbitrage in options pricing suggests that there shouldnt exist an oppo... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock