Question: Type or paste question here A real estate company has built two predil tive models for estimating the selling price of a house. Using a

Type or paste question here

Type or paste question here

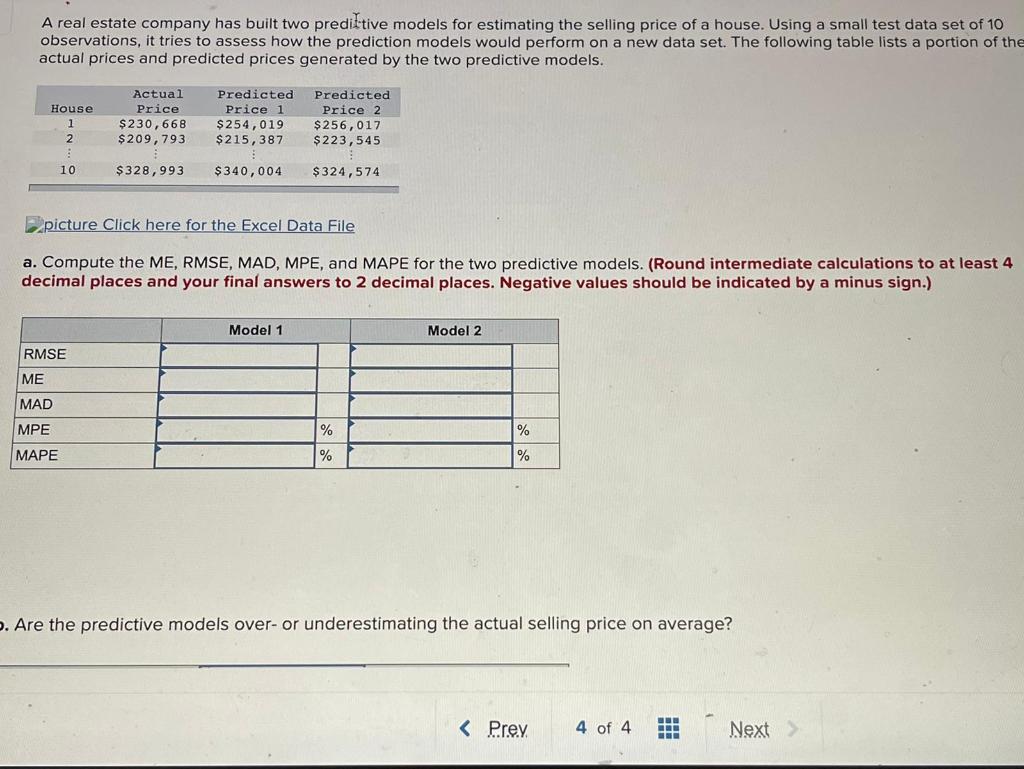

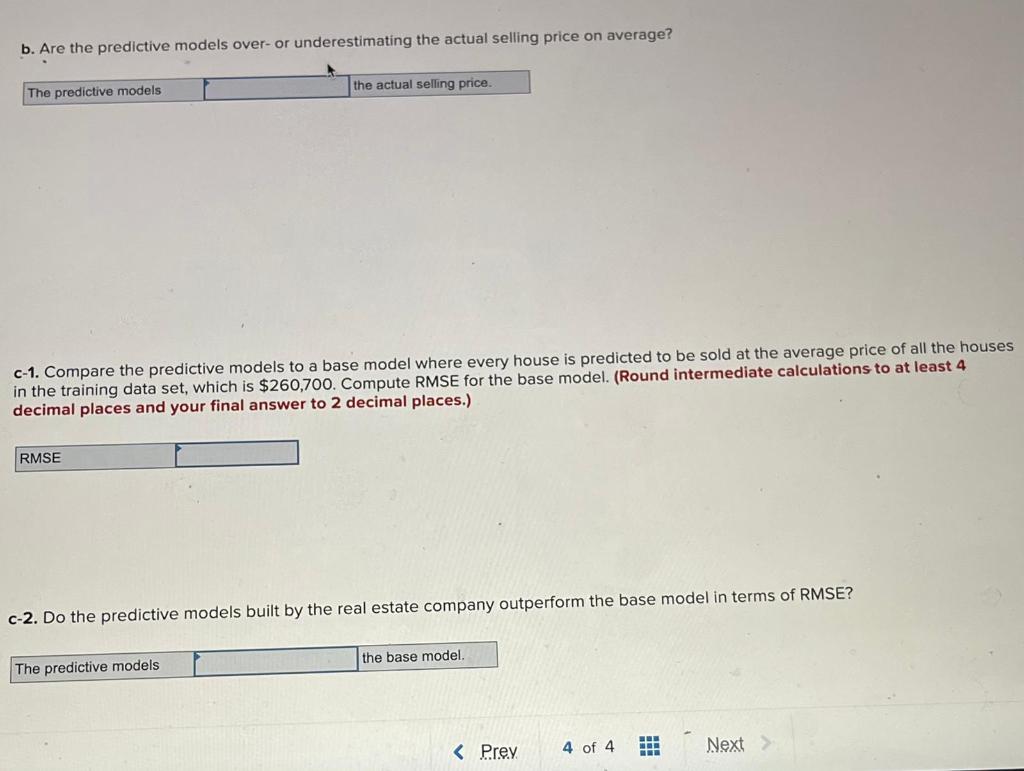

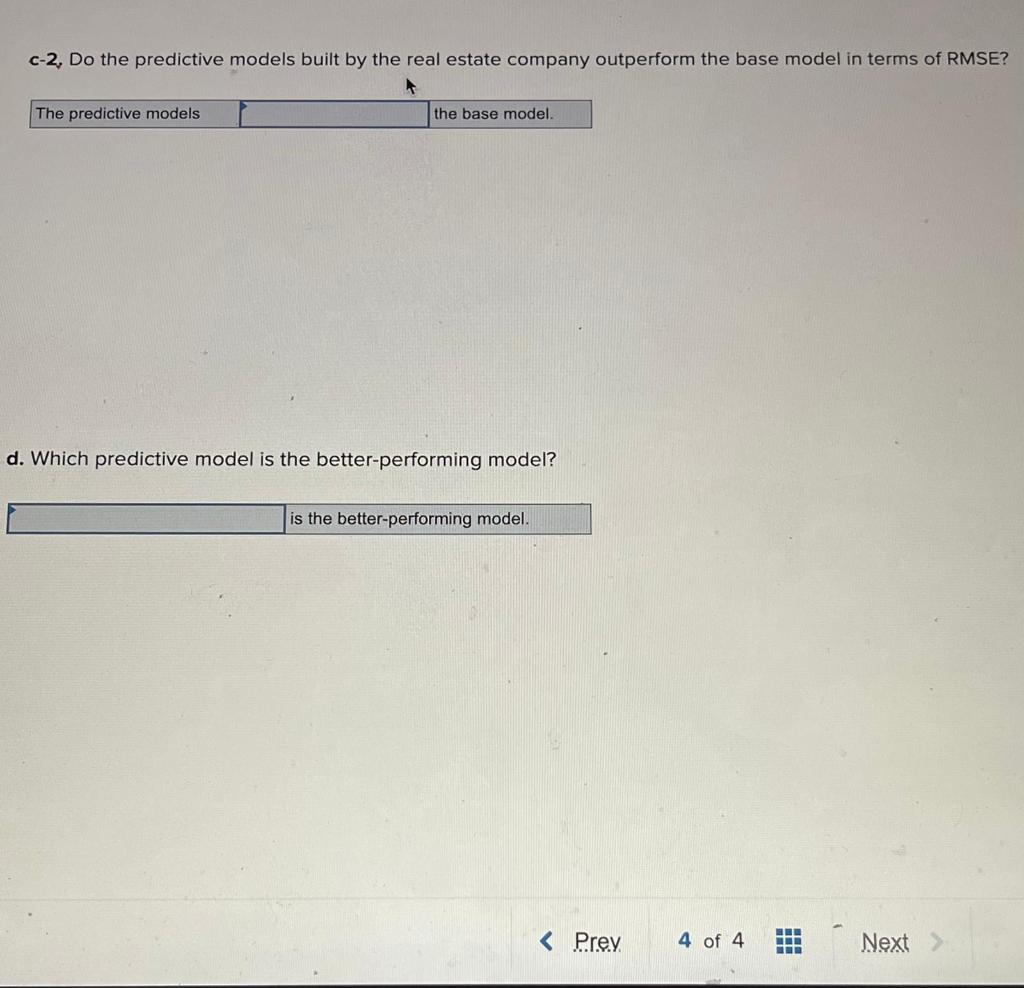

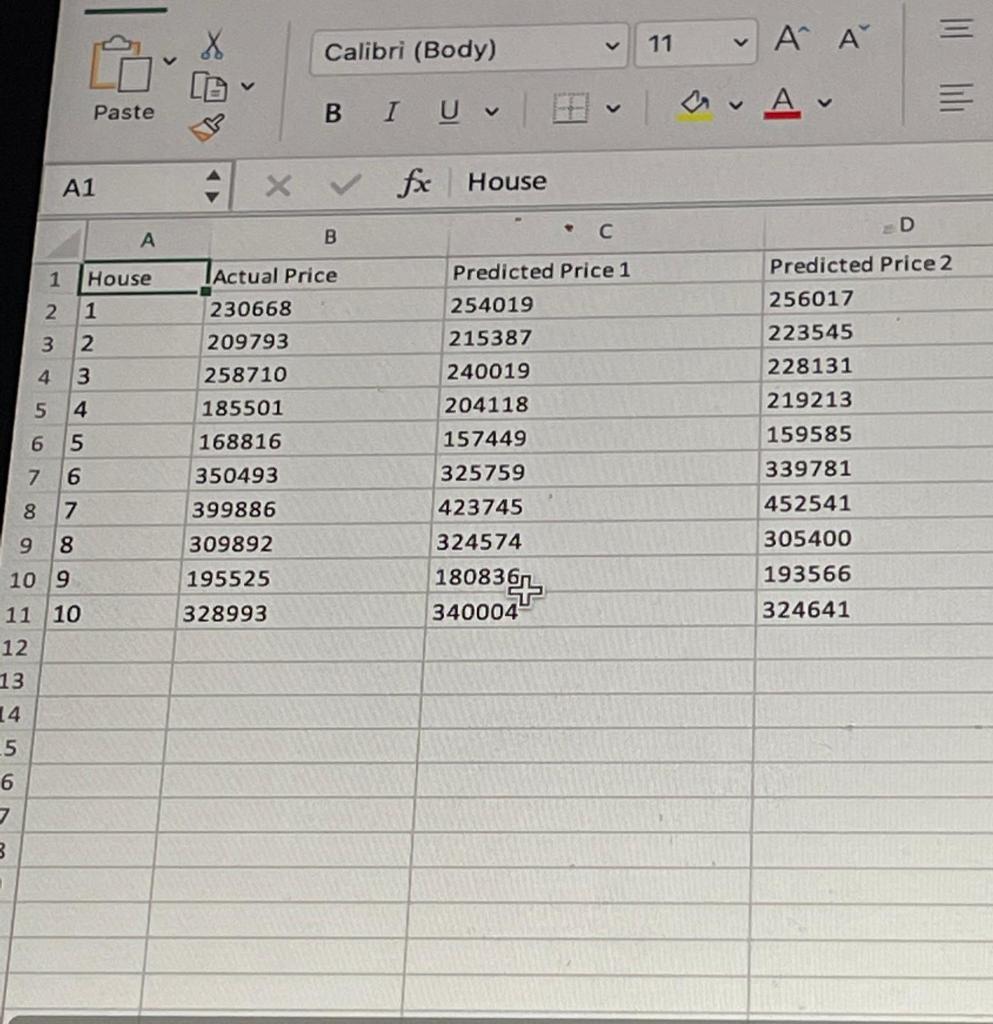

A real estate company has built two predil tive models for estimating the selling price of a house. Using a small test data set of 10 observations, it tries to assess how the prediction models would perform on a new data set. The following table lists a portion of the actual prices and predicted prices generated by the two predictive models. House 1 2 8 10 Actual Price $230,668 $209,793 Predicted Price 1 $ 254,019 $215,387 Predicted Price 2 $256,017 $223,545 $328,993 $340,004 $324,574 picture Click here for the Excel Data File a. Compute the ME, RMSE, MAD, MPE, and MAPE for the two predictive models. (Round intermediate calculations to at least 4 decimal places and your final answers to 2 decimal places. Negative values should be indicated by a minus sign.) Model 1 Model 2 RMSE ME MAD MPE % % MAPE % % . Are the predictive models over- or underestimating the actual selling price on average?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts