Question: A real estate company has built two predictive models for estimating the selling price of a house. Using a small test data set of 10

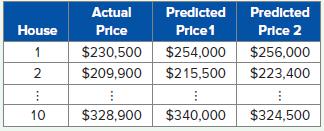

A real estate company has built two predictive models for estimating the selling price of a house. Using a small test data set of 10 observations, it tries to assess how the prediction models would perform on a new data set. The following table lists a portion of the actual prices and predicted prices generated by the two predictive models

a. Compute the ME, RMSE, MAD, MPE, and MAPE for the two predictive models.

b. Are the predictive models over- or underestimating the actual selling price on average?

c. Compare the predictive models to a base model where every house is predicted to be sold at the average price of all the houses in the training data set, which is $260,500. Do the predictive models built by the real estate company outperform the base model in terms of RMSE?

d. Which predictive model is the better-performing model?

House 1 2 I 10 Actual Price $230,500 $209,900 $328,900 Predicted Price 1 $254,000 $215,500 1 $340,000 Predicted Price 2 $256,000 $223,400 $324,500

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

a b Both models overestimated the actual selling price a... View full answer

Get step-by-step solutions from verified subject matter experts