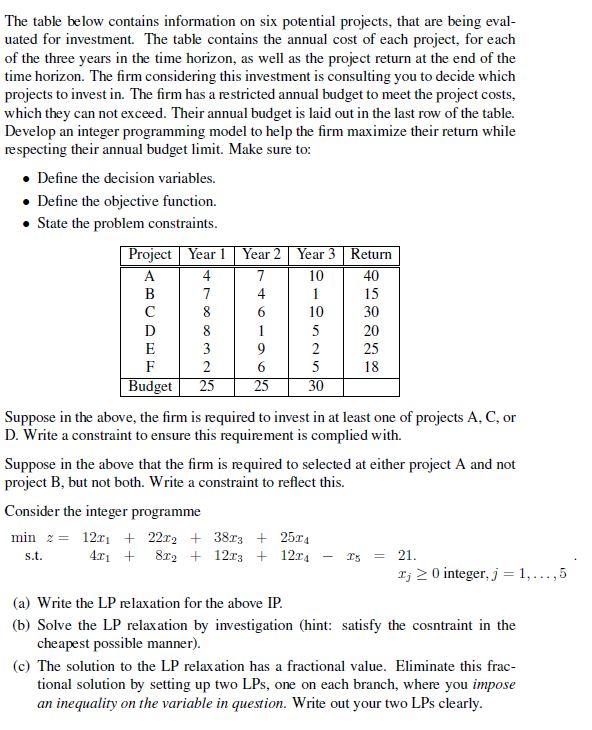

Question: Ua The table below contains information on six potential projects, that are being eval- uated for investment. The table contains the annual cost of each

Ua The table below contains information on six potential projects, that are being eval- uated for investment. The table contains the annual cost of each project, for each of the three years in the time horizon, as well as the project return at the end of the time horizon. The firm considering this investment is consulting you to decide which projects to invest in. The firm has a restricted annual budget to meet the project costs, which they can not exceed. Their annual budget is laid out in the last row of the table. Develop an integer programming model to help the firm maximize their return while respecting their annual budget limit. Make sure to: Define the decision variables. Define the objective function. State the problem constraints. Project Year 1 Year 2 Year 3 Return A 4 7 10 40 B 7 4 1 15 8 6 10 30 D 8 1 5 20 E 3 9 2 25 F 2 6 5 18 Budget 25 25 30 Suppose in the above, the firm is required to invest in at least one of projects A, C, or D. Write a constraint to ensure this requirement is complied with. Suppose in the above that the firm is required to selected at either project A and not project B, but not both. Write a constraint to reflect this. Consider the integer programme min 2= 12r1 + 22x2 + 3813 + 2514 401 + 8r2 + 1213 + 1214 21. Y;> 0 integer, j = 1,...,5 (a) Write the LP relaxation for the above IP. (b) Solve the LP relaxation by investigation (hint: satisfy the cosntraint in the cheapest possible manner). (c) The solution to the LP relaxation has a fractional value. Eliminate this frac- tional solution by setting up two LPs, one on each branch, where you impose an inequality on the variable in question. Write out your two LPs clearly. s.t. 25 Ua The table below contains information on six potential projects, that are being eval- uated for investment. The table contains the annual cost of each project, for each of the three years in the time horizon, as well as the project return at the end of the time horizon. The firm considering this investment is consulting you to decide which projects to invest in. The firm has a restricted annual budget to meet the project costs, which they can not exceed. Their annual budget is laid out in the last row of the table. Develop an integer programming model to help the firm maximize their return while respecting their annual budget limit. Make sure to: Define the decision variables. Define the objective function. State the problem constraints. Project Year 1 Year 2 Year 3 Return A 4 7 10 40 B 7 4 1 15 8 6 10 30 D 8 1 5 20 E 3 9 2 25 F 2 6 5 18 Budget 25 25 30 Suppose in the above, the firm is required to invest in at least one of projects A, C, or D. Write a constraint to ensure this requirement is complied with. Suppose in the above that the firm is required to selected at either project A and not project B, but not both. Write a constraint to reflect this. Consider the integer programme min 2= 12r1 + 22x2 + 3813 + 2514 401 + 8r2 + 1213 + 1214 21. Y;> 0 integer, j = 1,...,5 (a) Write the LP relaxation for the above IP. (b) Solve the LP relaxation by investigation (hint: satisfy the cosntraint in the cheapest possible manner). (c) The solution to the LP relaxation has a fractional value. Eliminate this frac- tional solution by setting up two LPs, one on each branch, where you impose an inequality on the variable in question. Write out your two LPs clearly. s.t. 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts