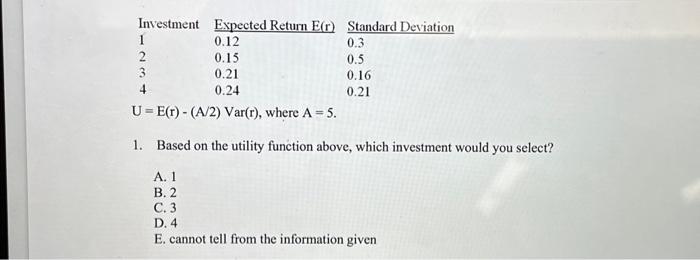

Question: U=E(r)(A/2)Var(r), where A=5 1. Based on the utility function above, which investment would you select? A. 1 B. 2 C. 3 D. 4 E. cannot

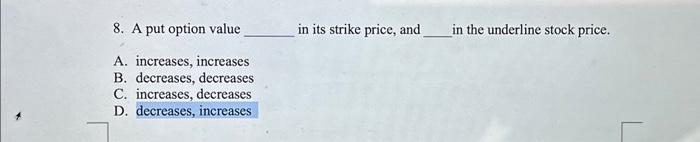

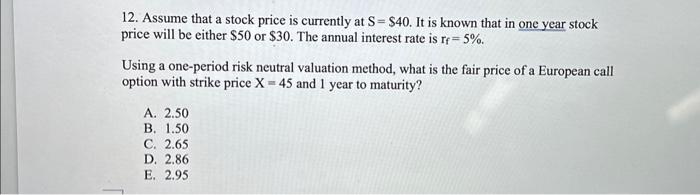

U=E(r)(A/2)Var(r), where A=5 1. Based on the utility function above, which investment would you select? A. 1 B. 2 C. 3 D. 4 E. cannot tell from the information given 8. A put option value in its strike price, and in the underline stock price. A. increases, increases B. decreases, decreases C. increases, decreases D. decreases, increases 12. Assume that a stock price is currently at S=$40. It is known that in one year stock price will be either $50 or $30. The annual interest rate is rf=5%. Using a one-period risk neutral valuation method, what is the fair price of a European call option with strike price X=45 and 1 year to maturity? A. 2.50 B. 1.50 C. 2.65 D. 2.86 E. 2.95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts