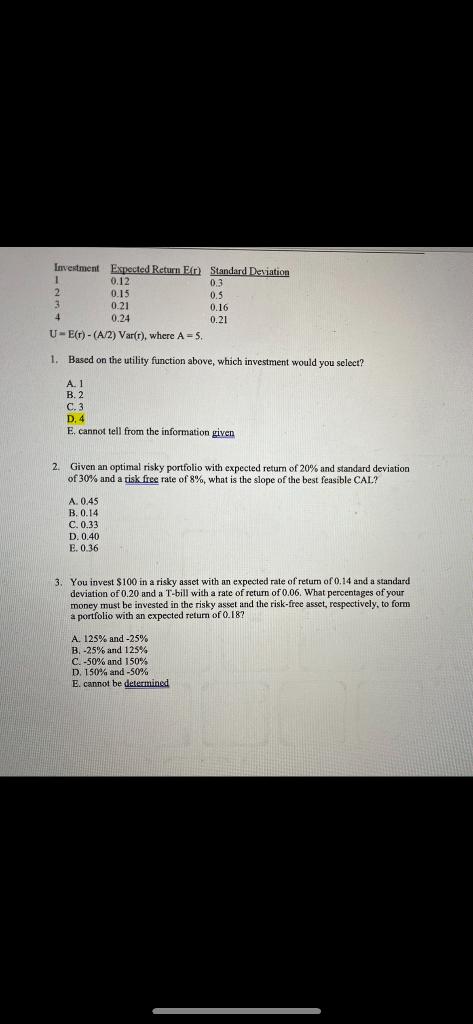

Question: U=E(r)(A/2)Var(r),whereA=5 1. Based on the utility function above, which investment would you select? A. 1 B. 2 C. 3 D. 4 E, cannot tell from

U=E(r)(A/2)Var(r),whereA=5 1. Based on the utility function above, which investment would you select? A. 1 B. 2 C. 3 D. 4 E, cannot tell from the information given 2. Given an optimal risky portfolio with expected retum of 20% and standard deviation of 30% and a risk free rate of 8%, what is the slope of the best feasible CAI?? A. 0.45 B. 0.14 C. 0.33 D. 0.40 E. 0.36 3. You invest $100 in a risky asset with an expected rate of retum of 0.14 and a standard deviation of 0.20 and a T-bill with a rate of retum of 0.06 . What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to form a portfolio with an expected retum of 0 . I 8 ? A. 125% and 25% B. 25% and 125% C. 50% and 150% D. 150% and 50% E. cannot be determined

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts