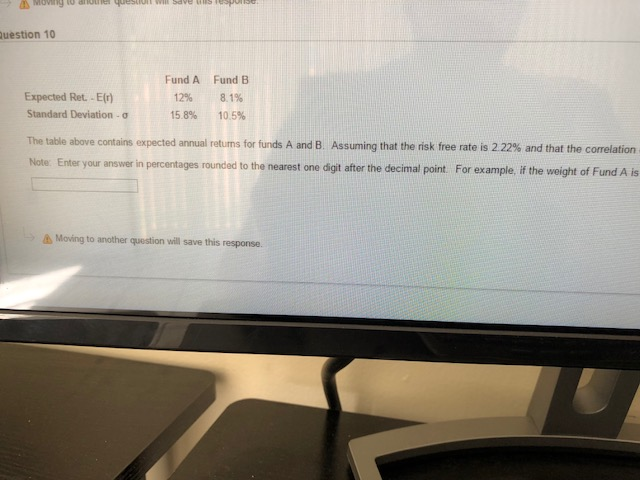

Question: uestion 10 Expected Ret. -E() Standard Deviation Fund A 12% 15.8% Fund B 8.1% 105% The table above contains expected annual returns for funds A

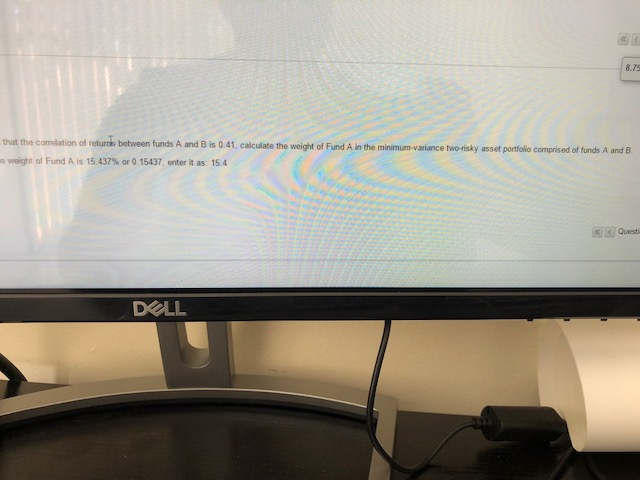

uestion 10 Expected Ret. -E() Standard Deviation Fund A 12% 15.8% Fund B 8.1% 105% The table above contains expected annual returns for funds A and B Assuming that the risk free rate is 2.22% and that the correlation e Enter your answer in percentages rounded to the nearest one digit after the decimal point For example, if the weight of Fund A is Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts