Question: undefined 1. A company is evaluating two projects (Project A and Project B). The cost of Project A will be $150,000 and annual net cash

undefined

undefined

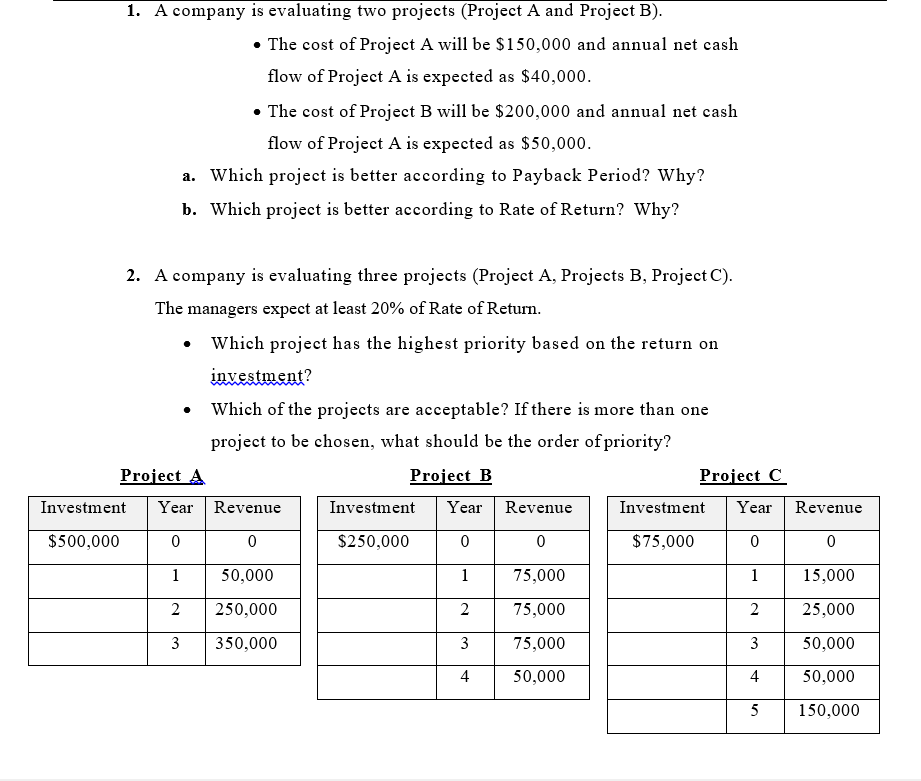

1. A company is evaluating two projects (Project A and Project B). The cost of Project A will be $150,000 and annual net cash flow of Project A is expected as $40,000. The cost of Project B will be $200,000 and annual net cash flow of Project A is expected as $50,000. a. Which project is better according to Payback Period? Why? b. Which project is better according to Rate of Return? Why? 2. A company is evaluating three projects (Project A, Projects B, Project C). The managers expect at least 20% of Rate of Return. Which project has the highest priority based on the return on investment? Which of the projects are acceptable? If there is more than one project to be chosen, what should be the order of priority? Project A Project B Project C Investment Year Revenue Investment Year Revenue Investment Year $500,000 0 0 $250,000 0 0 $75,000 0 Revenue 0 1 50,000 1 75,000 1 15,000 2 250,000 2 75,000 2 25,000 3 350,000 3 75,000 50,000 4 50,000 4 50,000 5 150,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts