Question: undefined Case Study-Brantley Accounting Services Brantley Accounting Services is evaluating three tax preparation software packages for its business. Although each package would have a useful

undefined

undefined

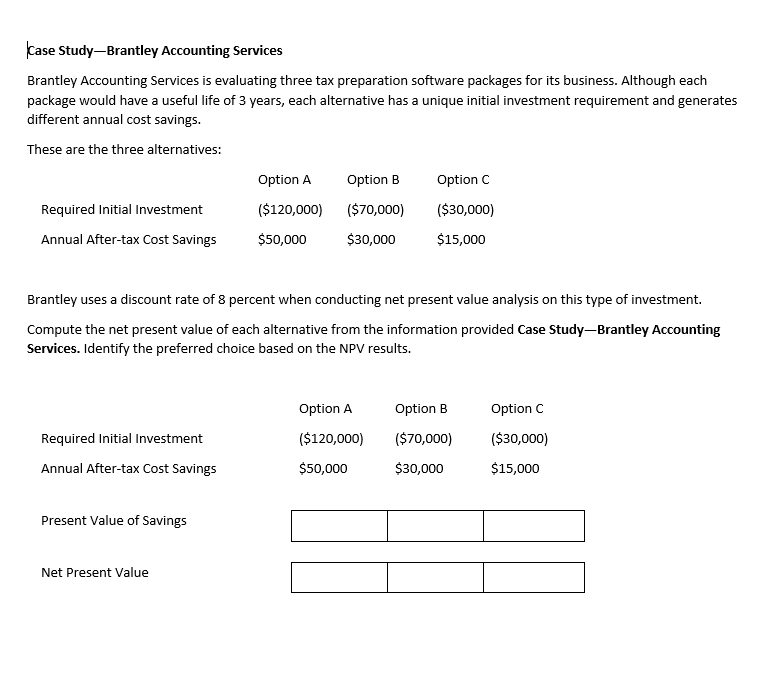

Case Study-Brantley Accounting Services Brantley Accounting Services is evaluating three tax preparation software packages for its business. Although each package would have a useful life of 3 years, each alternative has a unique initial investment requirement and generates different annual cost savings. These are the three alternatives: Option A Option B Option C Required Initial Investment ($120,000) ($70,000) ($30,000) Annual After-tax Cost Savings $50,000 $30,000 $15,000 Brantley uses a discount rate of 8 percent when conducting net present value analysis on this type of investment. Compute the net present value of each alternative from the information provided Case Study-Brantley Accounting Services. Identify the preferred choice based on the NPV results. Option A Option B Option C Required Initial Investment ($120,000) ($70,000) ($30,000) Annual After-tax Cost Savings $50,000 $30,000 $15,000 Present Value of Savings Net Present Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts