Question: undefined Fitzgerald Computers is considering a new project whose data are shown below. The required equipment has a 5-year tax life, after which it will

undefined

undefined

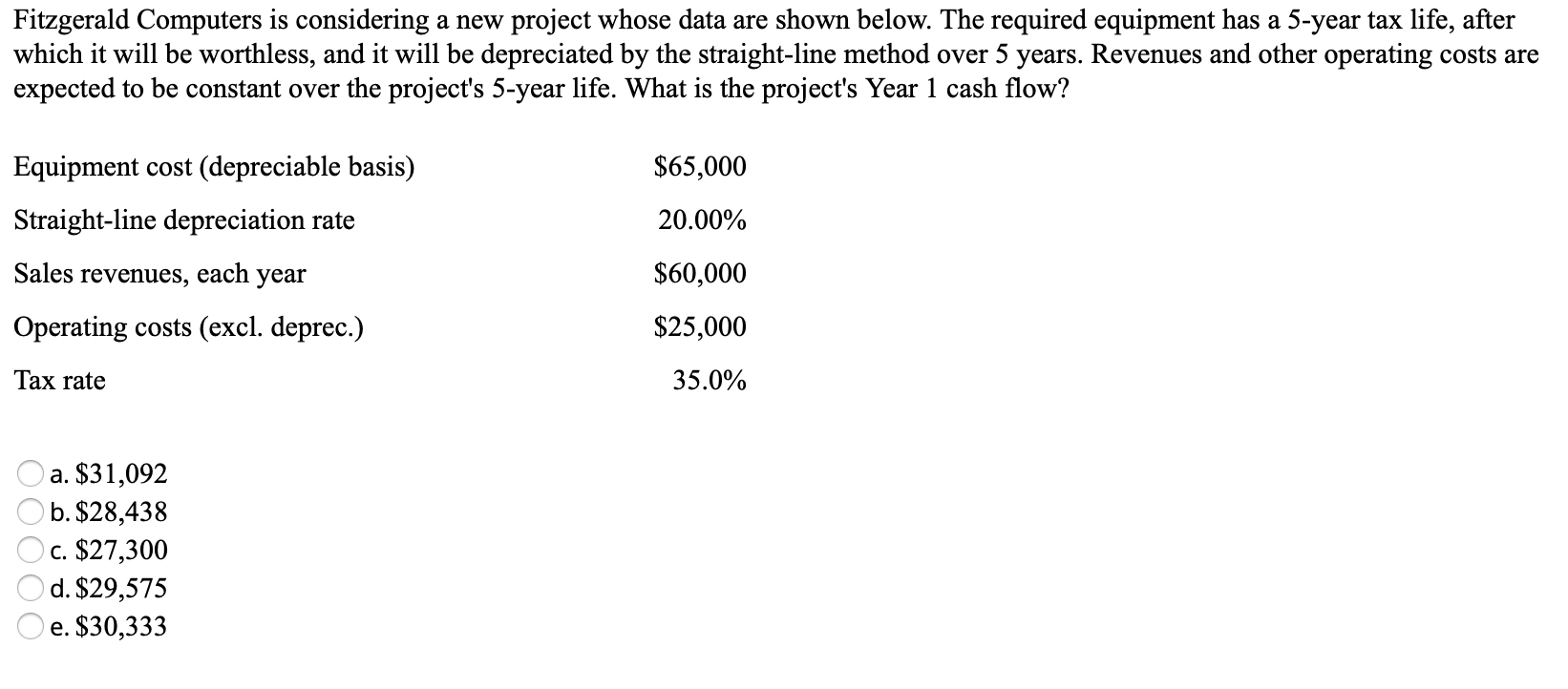

Fitzgerald Computers is considering a new project whose data are shown below. The required equipment has a 5-year tax life, after which it will be worthless, and it will be depreciated by the straight-line method over 5 years. Revenues and other operating costs are expected to be constant over the project's 5-year life. What is the project's Year 1 cash flow? $65,000 Equipment cost (depreciable basis) Straight-line depreciation rate 20.00% Sales revenues, each year $60,000 Operating costs (excl. deprec.) $25,000 Tax rate 35.0% a. $31,092 b. $28,438 C. $27,300 d. $29,575 e. $30,333 O O O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts