Question: undefined p O words Question 4 O pts An ABC hypothetical company must decide whether to introduce a new product line. The new product will

undefined

undefined

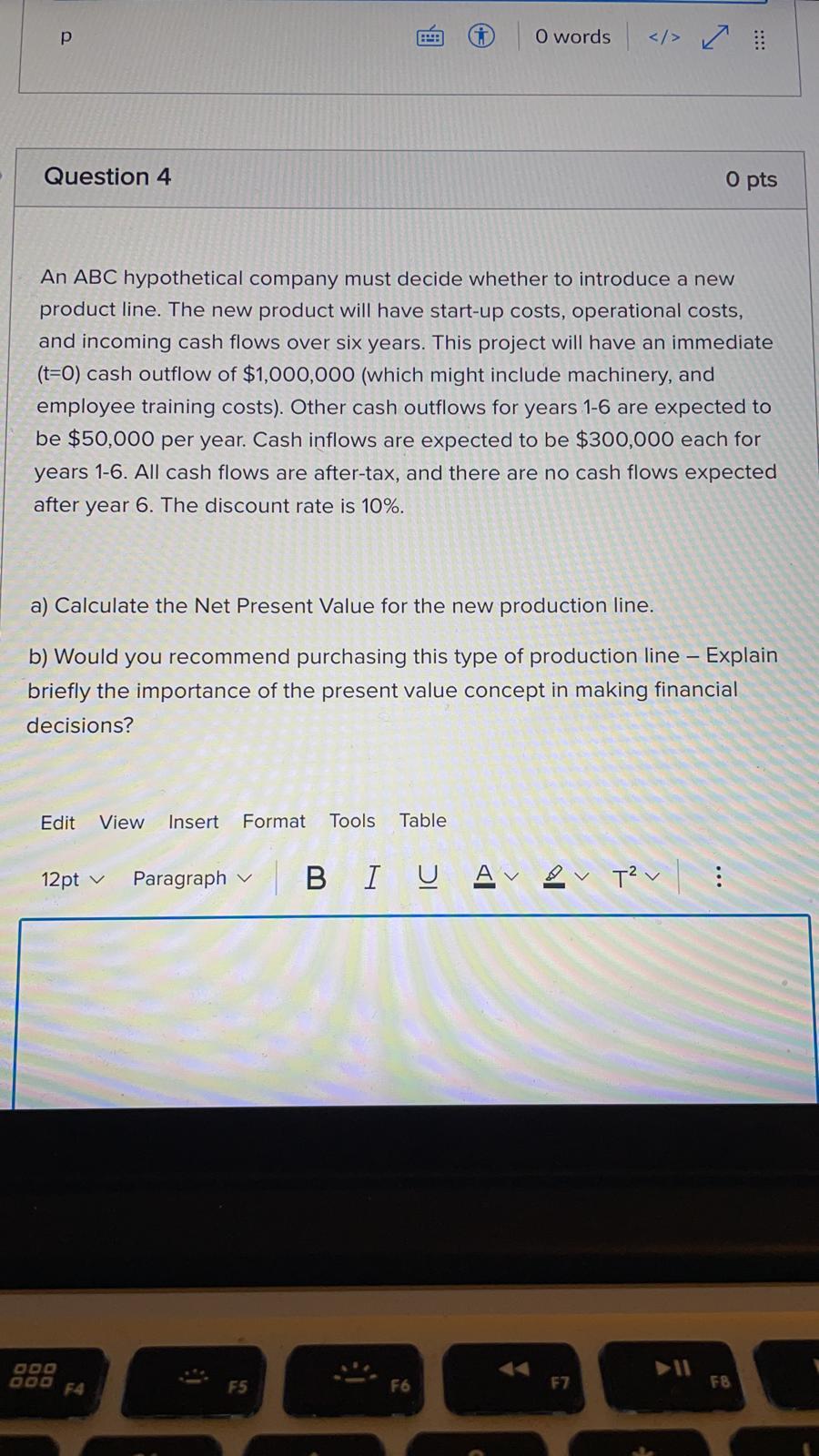

p O words Question 4 O pts An ABC hypothetical company must decide whether to introduce a new product line. The new product will have start-up costs, operational costs, and incoming cash flows over six years. This project will have an immediate (t=0) cash outflow of $1,000,000 (which might include machinery, and employee training costs). Other cash outflows for years 1-6 are expected to be $50,000 per year. Cash inflows are expected to be $300,000 each for years 1-6. All cash flows are after-tax, and there are no cash flows expected after year 6. The discount rate is 10%. a) Calculate the Net Present Value for the new production line. b) Would you recommend purchasing this type of production line - Explain briefly the importance of the present value concept in making financial decisions? Edit View Insert Format Tools Table 12pt v Paragraph Av Av T2 v 1 : DOO F4 F5 F6 F7 FB

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts